Few comments on the Q4 which went overall quite according to my expectations

Positives:

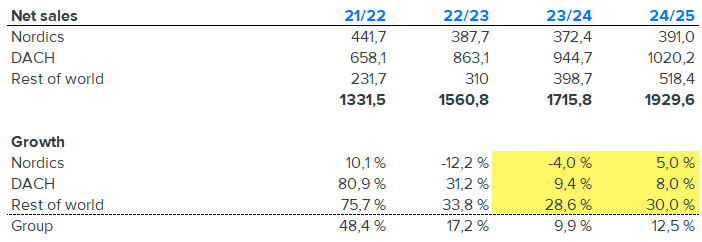

- Germany still performing extremely well in tough market (+16 % CX adjusted growth, +27 % in SEK)

- Rest of the World also still gaining momentum with 43 % growth (non CX adjusted). Especially positive comments on Netherlands, UK performing well, US growing fastest but still small numbers

- Canada, Japan and South Korea local sites launched today

- Slightly more positive comments in Webcast regarding the Nordic markets

- Gross margin at strong 74,5 % level, very strong level even when considering one-time positive effects

- Slight improvement in underlying operating profitability

- July and early August growing >14 %

- Overall great performance in very tough market conditions

Negatives:

- Nordics still in clear downtrend (-16 % non CX adjusted)

- Profitability still clearly below Q4’20 level (as expected)

- Other DACH-markets than Germany performing weaker than previous quarters

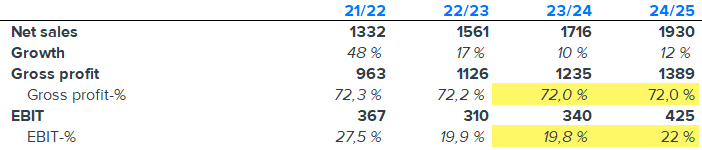

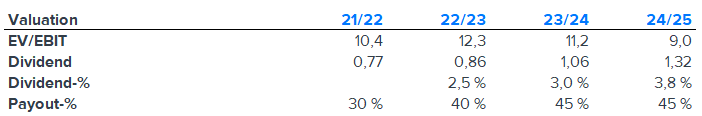

Here are my rough estimates for the next two years and valuation based on these estimates and 35 SEK stock price. Valuation still seems quite moderate considering the high growth potential combined with high ROIC and profitability improvement potential. Greatest risk in my opinion is the large share (almost 50 %) of German market. If Germany would start to deteriorate, it would be hard compensate with other markets for quite some time.

Disclaimer: I own some RVRC shares