If you’re interested in how Nordea’s Q2 went and how the company is doing, I believe this is the best way to get familiar with these matters:

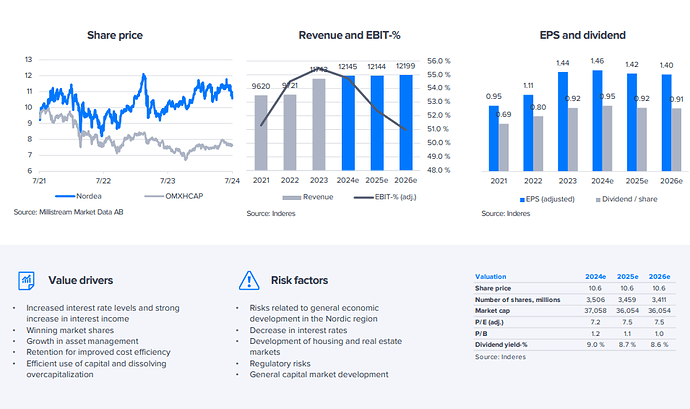

Nordea reported strong Q2 results in line with our expectations, with net interest income and fee and commission income developing as we had forecast. The bank’s cost development during the quarter also did not provide any material surprises, and the company’s profitability remains top-notch. In fact, we had to make only moderate changes to our estimates after the report. In our view, Nordea is still cheaply priced, in line with the rest of the Nordic banking sector, and the expected return looks attractive. We reiterate our EUR 12.5 target price and Buy recommendation.