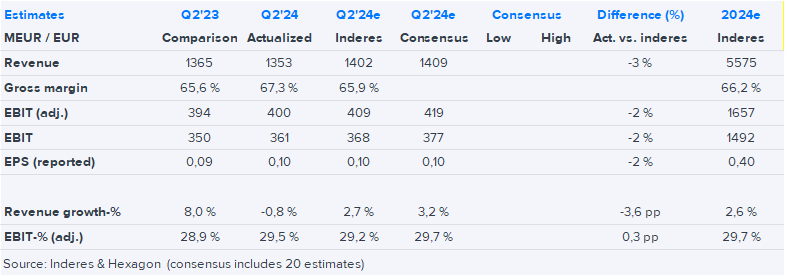

Q2 growth ended up weaker than we expected, which was also reflected in earnings, even if the relative profitability was rather strong. Sales came in 3% below our estimate and 4% below consensus. Adjusted EBIT was 2% below our estimate and 4.5% below consensus.

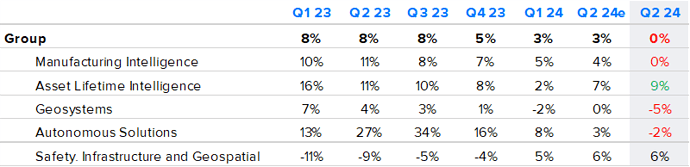

Here you can find the division-specific organic sales growth figures (y/y).

Large segments with material hardware sales, such as Manufacturing Intelligence and Geosystems, suffered due to cyclical headwinds in their certain important end-markets (automotive for MI and construction for Geosystems). However, recurring revenues, including software and services, grew by 8% year-over-year, indicating an improvement in the quality of revenue as expected. The gross margin reached an all-time high, and operational efficiency measures helped maintain the EBIT margin at a good level. This development signals good potential for earnings growth once the cyclical industries recover.