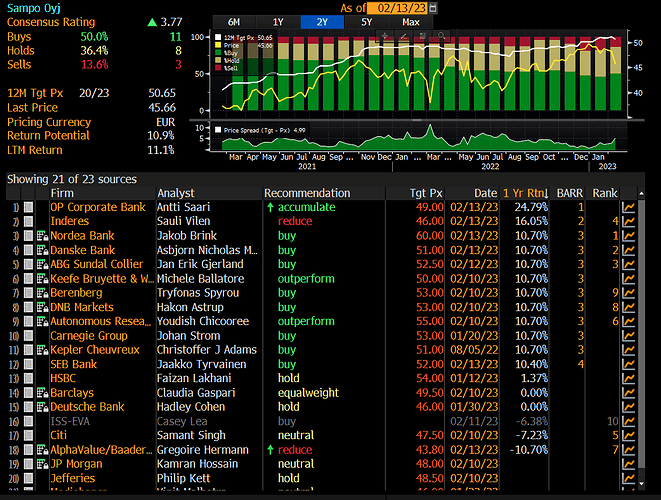

Updated analyst consensus by Bloomberg.

Sampo also has good investor pages, where to watch analysts’ recommendations and estimates.

Inderes analyst Sauli Vilén shared his thoughts on Sampo’s Q1. ![]()

Sampo had a good start to 2023 driven by robust growth and solid margins particularly in the Nordics. Analyst Sauli Vilén comments.

@antti.jarvenpaa interviewed Knut Arne Alsaker, the Chief Financial Officer of Sampo. ![]()

Sampo performed well in Q1’23, with If being the brightest of the businesses. Knut Arne Alsaker, CFO of Sampo Group, opens up about Sampo’s situation and plans.

Topics: 00:00 Start 00:20 Q1’23 00:38 If 02:18 Technical accounting changes 04:02 Market environment remains favourable 05:33 Mandatum spin-off 09:30 Topdanmark ownership 11:02 Future value drivers

The OP’s morning briefing focused on Sampo’s peer Tryg’s analyst day. Tryg plans to reduce its insuring of large corporate clients, which apparently has not been the best part of business, and to focus more on smaller companies in its corporate insurance business.

Based on OP’s comments, Tryg’s focus remains on profitability and the company’s comments did not suggest that the improvement in investment returns as interest rates rise would translate into a much tighter competitive environment and consequently a decline in underwriting results. Good news for Sampo.

We have published extensive research report of Sampo as of today! The analysis is available for free both in English (Sampo: The King of the Nordic P&C insurance market) and Swedish (Sampo: Kungen av den nordiska skadeförsäkringsmarknaden). In the report, we dive a little deeper into the dynamics of Nordic P&C Insurance market and Sampo’s value drivers. I hope you enjoy the content and please feel free to ask any questions regarding the report or Sampo in general here in the Forum.

Vi har idag publicerat en omfattande analys om Sampo även på svenska ( Sampo: Kungen av den nordiska skadeförsäkringsmarknaden). I analysen dyker vi djupare in i den nordiska skadeförsäkringsmarknaden och drivkrafterna för Sampos värdering. Jag hoppas analysen ger mer insikt i bolaget och ifall du har frågor om Sampo kan du ställa dem här på forumet.

Tryg published its Q2 results on Thursday, and the results fell below expectations in terms of underwriting results and investment returns. However, profitability was excellent, of course.

I wonder how Sampo’s subsidiaries, If and Topdanmark, are performing… Topdanmark’s results will be released on July 14th, and our Sampo’s on August 9th. ![]()

https://www.inderes.fi/en/tiedotteet/topdanmark-adjusts-modelled-profit-forecast-2023-dkk-1050-1200m-after-tax-and-excluding

Topdanmark released a negative profit warning just before the release of their Q2 result. Profit forecast for 2023 was adjusted down due to weaker than expected investment profits.

Tryg’s Q2 result fell a tad bit below market expectations, a comprehensive comment on the result (in Finnish) above ![]()

It’ll be very interesting to see whether Sampo has continued accumulating Top’s shares after the recent decline! I’d argue that Sampo’s management would want to acquire Top sooner rather than later, though one could argue that the situation has been the same for years and years already ![]()

Thank you very much, Johannes, for your thoughts and information! ![]()

That already gave me something new to think about and some new information, which is really great. Sampo is both an easy and a challenging subject for me to follow. ![]()

Sampo överträffade fint konsensusförväntningarna. ![]()

Exempelvis

EPS 0,60 mot 0,47

Antti intervjuade Ifs VD Morten Thorsrud om Q2.

Analytikern delade sina tankar om Sammos resultat för Q2. ![]()

Jag gjorde precis ett inlägg på twitter i stil med " Då Sauli Vilén kommenterar Sampo, lönar det sig att lyssna. Nästan som ett gammalt djungelordspråk :)!

Har själv funderat på vad som dröjer i Topdanmark affären… o Saulis kommentarer är spot on.

Blir intressant att följa utvecklingen gällande Mandatum framöver. + Vad som händer på resten av marknaden. Blir det konsolideringar, eller ej.

Konsensusprognoserna har uppdaterats. ![]()

Till alla som är intresserade av hur det går med MANDATUM!

Kolla in INVESTOR EVENTET IDAG!

Mandatum’s Investor Event – Thursday, Sep. 14 at 15:00 EEST (inderes.se)

On October 2nd, analysts Sauli and Kasper will cover it. ![]()

Här är en ny analys av detta företag. ![]()