Inga stora överraskningar idag när Riksbanken sänkte sin styrränta och öppnade dörren för ännu större sänkningar.

Greetings my fellow investors,

a Day Late, a Dollar Short was a song by Hanoi Rocks. My “weekly bulletin” is a day late, but I’m not short on the dollar. I’m quite sure that wasn’t the point of the song, but anyway, third week in Stockholm is behind.

It was clearly the worst week so far, and hopefully to come also. I lost 4 out of 7 days to a sickness. Flu & couching isn’t bad, but when the little one doesn’t sleep because of breathing problems, this is pretty much suitable to describe the situation. So I didn’t get much work done, but at least we seem to be back in business now.

Anyway, it wasn’t a completely wasted week. Here are some “highlights”:

- Value Creators concept is official out with Fortnox. Many thanks for @lucas.mattsson who did a good job with this one. Feedback is welcomed. @tommi.saarinen helped a lot with “automatic” data collection via Bloomberg, making the process much smoother in the future. We’ll be making a Swedish and Finnish versions also soon.

- Managed to get a very rough, quick and dirty template for the other concept under development - still much work to be done.

- Moved forward with some ESG analysis that I have had in a backlog for a while.

- Naturally normal analysis work was done, for example an update on Detection Technology and many news comments.

- Lots of other small stuff so I wont be a wrench on the wheels of Inderes.

Definitely not the week I was aiming for, but hey, no point in complaining about things you cannot control. Life happens and we move along towards better times. And hey, Kinnevik is up 6 % so at least investing is easy ![]()

PS. In case you dont know Hanoi Rocks, it probably just means you aren’t 100 years old. Even I’m too old for them, but I have educated myself ![]()

Jag, varje dag:

Greetings once again,

First month in Stockholm is already behind. I guess time flies when you’re having fun, but I think part of the reason is that there’s just so much to do and no time to slow down. Unfortunately we have still been little under the weather, but in general it was a good enough week. Hoping for a full recovery soon.

A bit of reflection from the last month. I have noticed that I have developed a much better understanding of our Swedish business, even though I have mostly tried to stay on my lane (equity research). So that’s a positive. Also, I think I know most of the people here, so that’s a big bonus, though there’s plenty of room for improvement in my “knowledge”. I have a much better grasp of the competitive situation here now – I knew it before, but it’s different to “live it" also. At the same time there’s a huge opportunity here for independent research, but the culture is so used to “cheerleading” and +XX % upsides to fair values that building trust and understanding takes time. It’s not an easy task to tackle, but it wasn’t easy in Finland either in the beginning. There’s a tipping point here also. We just need to find a way to get to it.

I have also noted some limitations that our current “system” has and hoping that we can improve on this in the future. Let’s just say that we need more co-operation between our local teams – and I hope to see plenty of my Finnish colleagues also here in Stockholm. I’m quite sure it will help us in the long run.

Some minor things from the last week:

-

Another Value Creator is out, this time Revenio from Helsinki. Currently there’s only a Finnish version but it will be translated to English and I guess Swedish soon enough. Here’s the link to the Finnish version. Hoping that we’ll get another out next week, but someone else has to do the heavy lifting this time.

-

I have been preparing myself to Q3 earnings season, meaning some pre-silent calls with the companies that I cover. No major surprises here, but naturally they wouldn’t tell this to me directly. There were plenty of negative profit warnings in my coverage during the summer. It’s a tough market situation especially in the professional services sector, but it’s nothing new anymore.

-

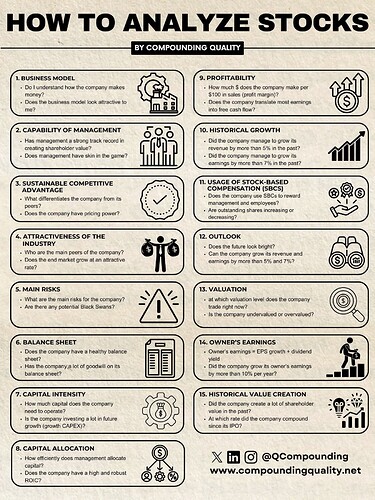

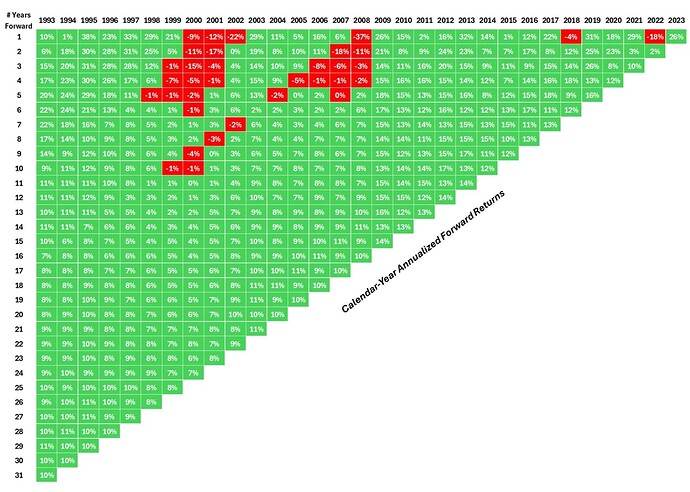

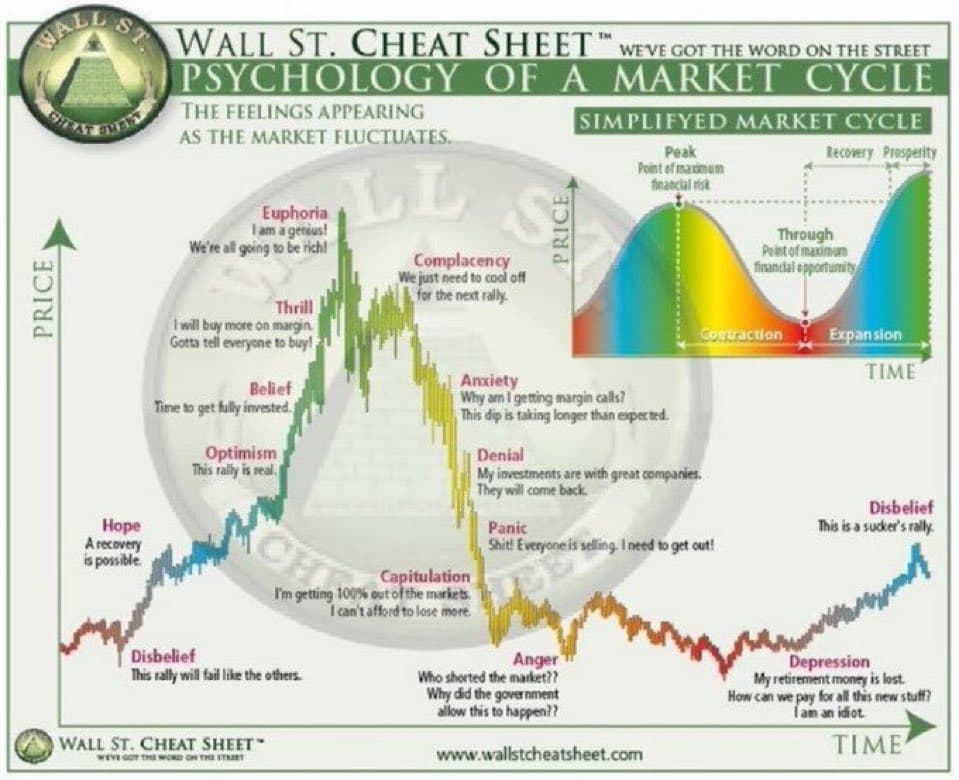

Good week in the stock market. I have been thinking about the stock market in general, because I’ll be making a presentation to our analyst team next week. I’m hoping to compile a solid data package prior to that, and it should help with other projects also. I suppose I need to start working on Q3 expectations report also, this is something that we publish in Finland. More about this next week.

-

Now that the silent period is starting, I can say that I made a mistake in my timing here: I should have focused on the outbound meetings while the window was open (and book them beforehand), but had too much internal stuff to do then. Now I have booked meetings etc. but they are happening after the earnings, which will be a very busy time then. Well, live and learn, I won’t run out of things to do anyway.

I’m sure I’m forgetting a lot, but I guess that’s it for this week. Next week should be more interesting with plenty of things to do ![]()

Do you see, that there is a market for you from finnish companies, that you could provide analyses also in swedish in Sweden markets?

I think it creates allways more trust, when there is an analysis in your native language. Nevertheless, everybody in Sweden speaks excellent english.

But are they as interrested to invest, if they have to get to know a company in english? I think in Sweden also media writes a lot of stories about big companies.

But how about small cap… I don’t think, they know them as well as finnish investors don’t know that many small caps in Sweden.

These companies are somehow reminiscent of me or my investing skills… ![]()

Yeah, the language question is a tough one. Even though the Swedes speak English, my gut feeling is that there’s a demand for Swedish content. In this world of “content overflow” one needs to make everything as easy as it can be - without losing the depth of analysis behind the content.

We have research in English and in Swedish from Finland, and I guess we need to dive into the data to find out what works. Of course there’s also the fact that majority of our Finnish analysts aren’t fluent in Swedish, so there’s much more pressure on the translation team to not only to translate but make sure that the “tone” of the comment comes through.

But certainly we have good content from Finnish companies that we need to get to this side of the bay. It’s one way to further strengthen our position also in Finland, when our reach grows.

There is a huge amount of small caps that are kind of under the radar here in Sweden, and of course visa versa when it comes to the knowledge of the Finnish companies here. This “cross-researching” is significant opportunity to us, but of course it will take time.

However, we also need to speed up the process and “ignite a spark”, and I believe that Value Creators can be that. I think we kind of need to serve an interesting company in a silver platter in the beginning, and if that works, those interested in the company will find more information. Again this is just my gut feeling, but I think that a 50 page extensive report isn’t going to the way that many investors want to get to know the company at first - but they might be reading that report after they know it’s worth their time.

And of course we need to find other ways to “introduce” companies to both sides. We are working on it ![]()

Yeah, I think there is very small amount of companies that ride under the radar in Finland. Big thanks to Inderes for that.

Ibland blandar jag ihop dessa “HEX-bolag”, det finns alltså fler än de som syns här.

Det blir roliga förväxlingar ibland, när man tror att man läser om ett visst bolag men egentligen läser om ett helt annat. ![]()

Greetings fellow investors,

Another week and a half behind – and clearly I’m behind on my “notes from Stockholm”. But it was one of those weeks that didn’t leave spare time for this, so I’m writing on Sunday while my son is having his nap. Many things have happened since I last wrote anything, here I’m just trying to find the “main events”.

Last week included a trip to Helsinki, where we had a Research Day. On last Thursday our Swedish team woke up around 4, fly to Helsinki with the morning flight and returned late in the evening. Tough day and I wouldn’t recommend these often thinking about the wellbeing of our team, but it was a productive day. Hopefully the development ideas that we came up will happen in the future, and of course it was nice to see Inderes people of Helsinki also. Also it was a pleasure to talk with many tech people as they were also present – it’s crucial that we make progress also in that front, and it seems that we will be doing that.

I gave a presentation about the “state of the markets”, which is pretty sad right now in Finland. It was a long presentation, but I guess to market outlook can be summarized to be prepared for a sideways market with a bullish flavor. There should be a bull from these valuation levels if the earnings growth begins to materialize, but economic outlook doesn’t look appealing so I wouldn’t bet the house on it. Making that presentation, including collecting a punch of data, was a big part of the beginning of the week. One can only hope that people found it useful, but at least doing the work forced me to take a hard look on things.

I was mentioned in “Regulatoriskt pressmeddelande” last week, when the Nomcom of Inderes (Nomination and Compensation Committee of the shareholders) officially gathered its wisdom. While nomcom might sound boring to many, it’s actually a very important committee. If we forget all the jargon and legal stuff in the between, its responsibility is the assemble the best possible Board of Directors for the company. The board has had a huge influence on the success of Inderes in the past, and they will do so also in the future. So important stuff!

The earnings season has begun and on Monday we published our preview for the Q3’24 earnings. That was another big content piece this week from me. Unfortunately Talenom gave a negative profit warning on Wednesday, and also changed its strategy. That was another long report, and this one was also translated to English, so feel free to read it here. Has been a frustrating case lately, but let’s see…

Normally would like to have an “easy week” prior to the earnings season just to collect my thoughts and prepare for the busy season. I would be lovely to go into the busy season batteries fully changed. This time I had a day (Friday), and it didn’t quite cut it. Bittium launches the Q3’s of my coverage on Friday, and there are plenty of things to do before that. It is what it is, and I didn’t come to Stockholm for a relaxing holiday.

Alright, my son has awaken, time to play ![]()

Gillar du att lyssna på intervjuer och annat i podd-format? Då kan jag äntligen meddela att vi finns på Spotify/Podcast appen i IOS! Det är så kul att du nu kan ta del av framförallt de långa intervjuerna direkt i podd-format. ![]()

Spotify - https://open.spotify.com/show/7fb7R7SWA12Uhq9oRj9X47?si=6f2ae703656341f1

Apple Podcast - Inderespodden Podcast Series - Apple Podcasts

Följ oss där så missar du inte när ett nytt avsnitt publiceras!

Ännu mer Inderes till folket! ![]()

På Instagram utlovas mer behind-the-scenes framöver samt annan content som ej syns på andra plattformar. Så följ oss gärna på Instagram för att lära känna oss på Inderes bättre och fritt fram fråga oss vad ni vill.

Marianne har en vän med i videon, vem är det? ![]()

![]()

Bra fråga, vet faktiskt inte var den gulliga hunden heter. ![]() @Isa_Hudd, vet du?

@Isa_Hudd, vet du?

Hörni! Nytt koncept från oss på Inderes, börsspaningar. Kika gärna och har ni frågor är det bara att hojta eller om det är något specifikt ni vill att vi ska diskutera.

Detta var ett trevligt nytt koncept! Förhoppningsvis ser så många som möjligt detta! Tack! ![]()