Greetings after a prolonged silence,

The end is near, but I just mean that my time in Stockholm is coming to an end. So nothing dramatic, though I might think that world is ending looking at the valuations of some Helsinki Stock Exchange companies.

It has been an interesting 2,5 months to say the least. It has also been 26 days since I wrote about my endeavors, or lack of them. Mostly this is due to the earnings season that always demands all your time and focus, but there were some other difficulties also. But no one wants to hear complaining, so let’s focus on the positive.

Lessons learned

So many that I still don’t have time to go through all of them. But in a nutshell: Sweden is a completely different beast than Finland. We need to sharpen our focus and improve our offering to take over the Swedish market. It will be a long and probably a rocky road, but eventually we’ll do it. Just because independent equity research is needed, and others don’t seem to be inclined to offer it. Good things take time, but I believe that we a have good foundation to build on.

Many thanks for @lucas.mattsson and @christoffer.jennel for working with me here. I don’t know if I was able to help you guys, but I certainly learned a lot during my visit.

I still have Monday left at the Stockholm office, but thanks for everyone I have been working with here. It has been my pleasure. I’ll check out the new office on my next journey

Stockholm

It’s a nice place. A big city that really doesn’t feel that big outside of the city center. Plenty of things to do, and I wish we had more free time as a family. Very “child friendly” city in general, which is a significant factor nowadays. Nice and polite people in general. Disappointments were the unreliable public transport system (I guess my expectations were too high) and the healthcare system (for us “foreigners”).

All in all, a very positive experience of the city. We’ll be back, or at least I’ll be back.

Investments in Sweden

I really thought that I’ll have plenty of time to research companies (outside of my coverage and their peers), but I was completely wrong. I’m still holding on to Kinnevik that was my first investment here. I was hoping to visit the CMD, but unfortunately a company that I cover changed its earnings day to that date. Still haven’t had time to research the portfolio, so I’m still in the dark whether the investment makes sense or not. Either I’ll do the research and find the conviction to own it or I’ll sell it quite soon. We’ll see. So far it has been +/-0 %.

I invested a small amount in Surgical Science lately. It’s starter to motivate me to do the work. Maybe I’ll have a chance to do that in the coming weeks, as I should have a holiday. Naturally I’m down already  In addition I still own some shares in Investor. Steady as it goes.

In addition I still own some shares in Investor. Steady as it goes.

Q3 earnings season

It was quite a ride that started with a wave of negative profit warnings. In general it is a very challenging period in Helsinki, but Q3 wasn’t as bad as one might think based on the stock market reactions.

- Administer: Q3 report was in-line with our estimates, 2025 estimates down

- Aspocomp: Q3 result was a disappointment, but outlook improved

- Bittium: Q3 result was a lackluster, but no major changes in the big picture

- Detection Technology: Q3 result was better than expected, outlook was a disappointment

- Fondia: Q3 report was in-line with our estimates

- Fortum: no significant surprises in Q3 report

- Etteplan: poor Q3 as expected, long-term case intact

- Revenio: Q3 was a disappointment, but no real reasons to worry

- Talenom: Q3 was a bit better than expected, but Mr. Market has lost all hope

- Optomed: Q3 somewhat in-line with expectations, positive development in general

- Panostaja is in a different reporting cycle, so it’ll report later

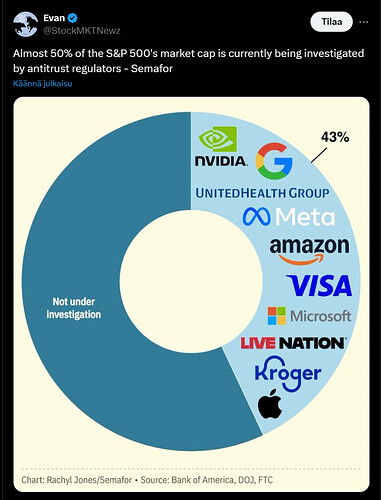

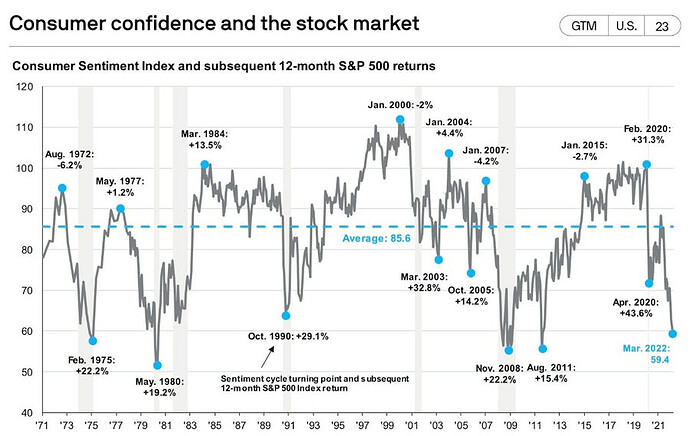

Naturally I haven’t been in Finland now, but I do mostly interact with Finnish companies and with Finnish investors. It seems to be a weird period in Finland. I have been an analyst for some 20 years, and it’s difficult to remember more pessimistic atmosphere regarding the local stock market. It kind of feels like the post tech bubble (2000 version), when everyone was just depressed and licking their wounds. Many new investors came in at the top (I was one of them) and left after the crash (I wasn’t one of them). Those you stuck around were rewarded greatly later on, but of course that’s a guarantee for the future.

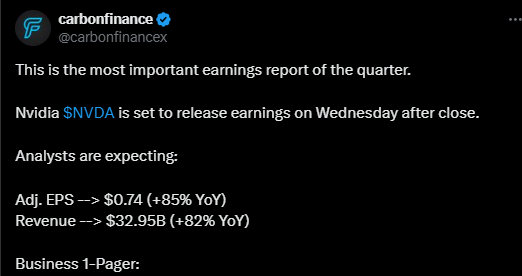

Now those actively who invest tend to focus more and more on US where the returns have been strong. Momentum is the key in the short-term, but it’s not my game. I have done my share of chasing returns. I try to buy stocks when the expectations and valuations are low, and I’m not in hurry. So Helsinki it is for my stock picking (I do have indexes in US). I see a lot of value also in the companies that I cover, and I have unusually high amount of positive recommendations. We’ll see whether I’m wrong or Finnish Mr. Market is actually too depressed, but I would recommend those of you investing internationally to take a look in Finland. It just might surprise you.

When it comes to Swedish market, it seems like there are similar situations behind the “big ones”. So I’m quite sure there are lots of opportunities in small- and midcap -segments here also, but I’m starting to accept that I just don’t have the time to research them. Wouldn’t it be great if there would be high quality independent research widely available?

Have a nice weekend and good investing!

![]() .

.![]()