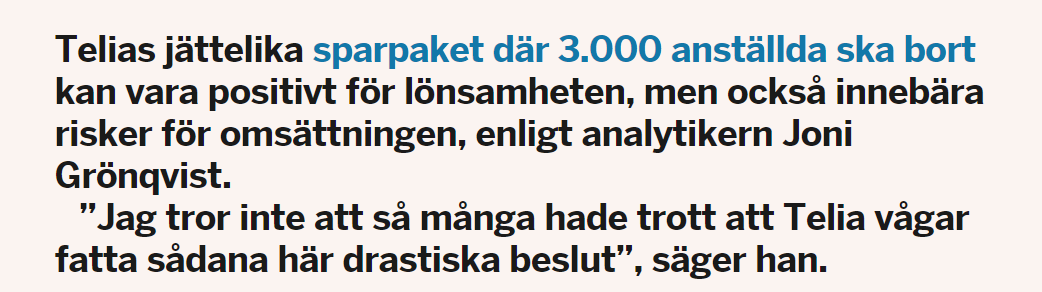

Yey! Vår egen @joni.gronqvist nu i DI ang. Telia!

Greetings fellow investors,

I have been in Sweden for a week now, so I thought it might be time to write something about my experience so far. These are far from scientific and probably relevant to no one particular, but here we go anyway. I’m probably forgetting a lot, but at least I’m making an effort.

First couple of days were spent just to get settled in, which isn’t quite that simple with a small child. But it’s pretty much done now, and we are moving along. Next it was important to find myself to the office, which was easy when the metro was working. When it wasn’t working one day, the whole transportation system was a mess. Brings me back to my days in London, where the tube was wonderful - expect when it wasn’t working. But I don’t need the Google Maps anymore to find here, so progress is being made ![]()

So what have I accomplished so far?

- I have met a lot of people here, which is always nice. It’s always good to try to know the people you’re working with, and after all, this is a people business.

- We have been tackling some analytical problems, where I have been a good listener and not so great at solving the problems. Trying to be supportive anyway

- I have reached out to some of the companies that I cover and have significant business in Sweden. Naturally I’m trying to meet the local management and improve my analysis that way during my stay here. Local insights might be valuable one day. First meeting is in the calendar, at least some movement here

- I have also reached out to some Swedish companies that I’m interested in. Well, only one so far, but hoping to improve soon. It’s always good to discuss with peers and competitors if one has a chance. Plenty to improve here!

- I haven’t had time to investigate interesting investments opportunities so far, but hopefully I’ll find something during my stay…

- Naturally I have done my normal work as an analyst in the Finnish companies, and I have tried to develop another “product concept” but this one will take time.

- “As a family” we managed to visit Skansen during the weekend. It was nice until the little one got tired and hungry. Then it wasn’t fun anymore, but everyone has recovered. Stockholm is a nice city in general.

The main event so far was still closer to home: Sotkamon Jymy, my hometown Finnish baseball team, was playing in the finals during the weekend against Tampere. Despite being underdogs in the finals, Sotkamo managed to win both games and is leading the series 2-0 ![]() It’s best out of 5, so one more win and we would be the champions again. For some reason I didn’t see this in the Swedish press, but nevermind…

It’s best out of 5, so one more win and we would be the champions again. For some reason I didn’t see this in the Swedish press, but nevermind… ![]()

It was a busy week - and I have pretty much nothing to show for it. But good things take time, and a new week is already on its way. ![]()

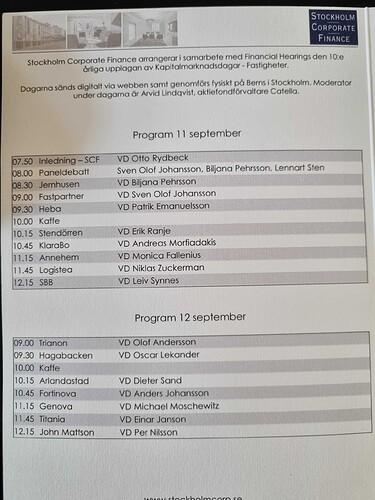

I samband med Stockholm Corporate Finance 10:e Fastighetsseminarium intervjuade vi samtliga 15 deltagande bolag, alla fastighetsbolag. Väldigt roligt att få en pratstund med så många fastighetsbolag, se mer här nedan:

Rekommenderar verkligen samtliga intervjuer! Även bolagspresentationerna är givande för alla som vill grotta ner sig i fastigheter!

Dessa bolag presenterade:

Direktlänk till varje bolagspresentation återfinns i intervjubeskrivningen för varje bolag.

Behind the svenes på Fastighetsdagarna: beredda på VD-intervjuer!

Sådana “lilla” företag är lätt att glömma, men kanske därför ville jag lyfta fram det. Jag tycker det är bra att hålla ett öga på olika företag, eftersom det alltid kan dyka upp intressanta möjligheter därifrån.

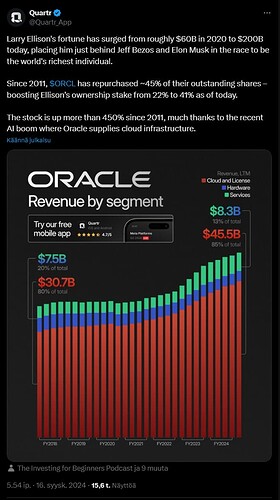

Har ni märkt att Larry Ellison nu är världens tredje rikaste man?

Greetings my fellow investors,

The second week of my excursion in Sweden is behind now, so I’m taking 10 minutes to write something about it. It’s been busy week again, with huge amount of small, uninteresting stuff. Not sure if these are interesting either, but here we go. Here are some things that I have been doing the past week:

Value creators concept

I “invented” a new concept called “Value creators” – a short, simple and visual report on high-quality companies that investors could be interested in. I’m hoping it will provide a good way to get to know basics of new companies, something that I have been working on here also. The feedback from the Finnish community was good and we are moving forward, so I’m hoping our Swedish equity research team will make its first case before the next week is over. No pressure @lucas.mattsson ![]()

You can find more info, unfortunately in Finnish, here.

By the way, when I told you that I was working on “product concept” last week, it wasn’t this one. This was just an idea I got and decided to run with. Another one is still work in progress, and I suppose I’m running late due to this idea. Well, better get on with it then.

First investment during my visit

I told you that I wanted to find some Swedish companies to invest in. Well, I have gone through some companies now. The only actual investment that I have made was Kinnevik that seemed to be in an interesting situation. I have absolutely no confidence in my small investment for now, so “don’t try this at home.”

I guess Kinnevik is well-known in Sweden, but I hadn’t heard of it before. I stumbled into in listening to podcast and was a bit intrigued. They seemed to be “Ark Invest of Sweden”, especially looking at the bubble era, and now they seemed to be struggling. Discount to NAV was large (~45 % if I remember correctly) and some crazy one had paid a similar premium to NAV at the top ![]() At least I’m expecting to do better than that one. Kinnevik seem to be going through a change, maybe for better, maybe for worse. Let’s see what they are going to tell at CMD next month. Note that I haven’t made any analysis of the companies that they have invested in, so I have no way of telling whether they are “correctly” valued in the portfolio. That’s a problem for the future Juha.

At least I’m expecting to do better than that one. Kinnevik seem to be going through a change, maybe for better, maybe for worse. Let’s see what they are going to tell at CMD next month. Note that I haven’t made any analysis of the companies that they have invested in, so I have no way of telling whether they are “correctly” valued in the portfolio. That’s a problem for the future Juha.

My “Swedish portfolio” now consists of Investor (that I have been owning for a longer time) and Kinnevik (tiny position). Both are investment companies, so I guess I’m hoping that they know what they are doing even if I don’t. But I can assure you, this is not the type of investor that I’m normally, and these are the only investment companies in my portfolio. Normally I want to understand exactly what I’m investing in and do a deep dive myself, but now I just wanted to get moving. And when it comes to Kinnevik, I typically like predictable cash flow, not aggressive, unprofitable growth companies. But actually that was one factor that I liked in the pick – otherwise I wouldn’t have any exposure to companies like this. Let’s see how it goes.

Other stuff worth mentioning

-

We just filmed a model portfolio video that’s coming out today or tomorrow. Our model portfolio (“Mallisalkku”) that invests real money has a great long-term track-record, but we have been struggling the past three years. Well, we’ll get back on track eventually.

-

I wrote “Kinnusen jorinat” piece just now, I suppose it’s kind of investment blog published in inderes.fi. Just some ideas about investments, markets and other things that I might find interesting. This time I wrote a small piece about the B2B companies and their (poor) market situation in Finland. It’s in Finnish, but I suppose google translate will make sense of it, if you want to check it out.

-

I haven’t been too active in the “reaching out department” because I have been very busy with my own stuff and supporting some colleagues here. Again I’ll try to improve.

-

“As a family” we managed to visit Gamla Stan during the weekend. Again it was very pleasant until our son got hungry. So if you heard “Ruokaa nyt” shouted loudly there, it was probably my son. But after we got food, it was all good again. In general everything is fine as long as we get enough sleep (ain’t that the case always).

-

I had a beer with our CEO @mikaelrautanen yesterday. It was a good beer.

-

Last but definitely not least: Sotkamon Jymy won the championship in Finnish baseball with a sweep (games 3-0) against Tampere. 21st championship in our glorious history. It was cool.

Another busy week, and a new week is already on its way. This took way longer than 10 minutes, so I’m late again ![]()

Meanwhile, since I’m no longer an equity analyst, I started to do my deep-dive analysis about pizza

Great suggestion! I hope soon, love these on the “soon-to-come” fall ![]()

Hej alla! UNDERBARA gäster i studion!!! Hade äran att få inga mindre än Kvalitetsaktiepodden på besök!! ![]()

![]() Tala om att vara starstruck!!

Tala om att vara starstruck!!

Intervjun tar en timme och en kvart, men rekommenderar av hela mitt hjärta!! Nästan lika bra som ett KAP avsnitt, men bara nästan ![]()

Kvalitetsaktiepodden: Investera disciplinerat och osentimentalt! - Inderes

I’ve seen a few vests and pataguccis around our team, everyone can dress as they see fit ![]() Disciplined anarchy, and some have more anarchist flair

Disciplined anarchy, and some have more anarchist flair

Här finns utmärkt läsning för alla typer av investerare.

Lär dig och läs! ![]()

Om jag ändå hade köpt Apple?

Under den tiden hade jag hunnit sälja Apple-aktierna tiotals och tiotals gånger. Ingen idé att älta det…

Amazon is a strong portfolio choice, as it has demonstrated steady growth, particularly through its e-commerce and cloud services, such as AWS. The company’s revenue and net income have increased significantly, and it invests in future technologies like artificial intelligence and its logistics network. Despite competition and economic challenges, Amazon’s innovation and ability to dominate create a long-term competitive advantage.

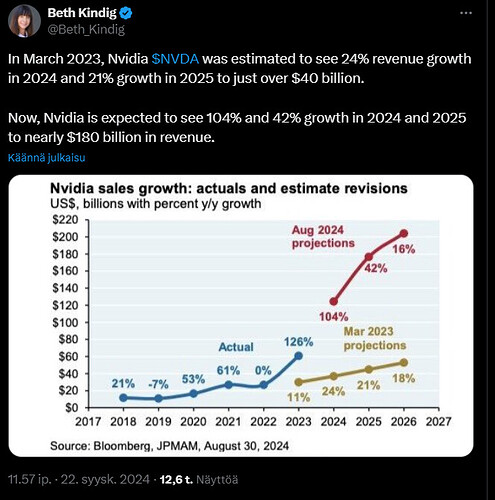

Den nedanstående tweeten berättar att Nvidias förväntade tillväxt är betydligt större än tidigare uppskattat. Till exempel beräknades det i mars 2023 att företagets omsättning skulle öka med cirka 20 % under åren 2024 och 2025.

Nu, enligt de senaste uppskattningarna, förväntas tillväxten vara över 100 % år 2024 och över 40 % år 2025, då omsättningen närmar sig 180 miljarder dollar.

Detta är perfekt, tack @lucas.mattsson! ![]()

In the Value Creators concept, we highlight companies that have created substantial shareholder value. Fortnox, best known for its cloud-based accounting software, is a leading ERP provider for small and midsize enterprises in Sweden. It has a strong track record of profitable growth and high returns on capital.