Ny analytikerintervju med @anton.damsten

MGI will publish its Q3 results on Thursday and here are the analyst’s thoughts on it. ![]()

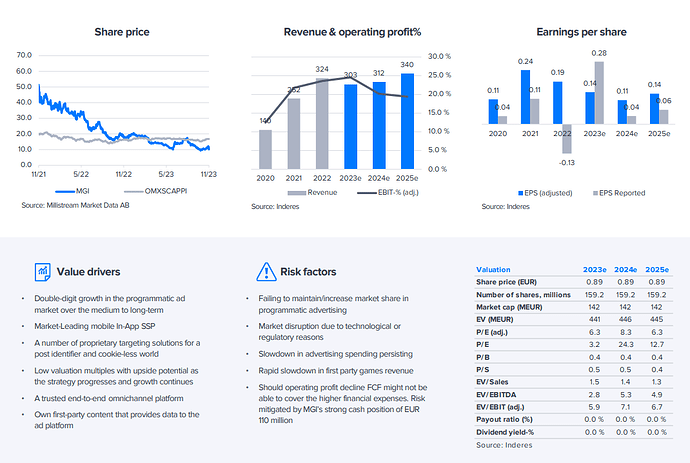

MGI will publish its Q3 results on Thursday morning. During the quarter, MGI managed to increase its market share in the key segment of mobile in-app advertising. However, the softness in ad demand has continued. Consequently, we expect the pricing of ads to have remained depressed, leading to declining revenues in line with the company’s updated full-year guidance. We expect operating profits for Q3 to be somewhat higher than in the comparable quarter due to the strong cost control demonstrated by the company during H1’23.

"MGI - Media and Games Invest SE: Resilient Organic Revenue Growth of 1%, EBITDA Margin Increased to 29% with Strong Free Cashflow. Company Notably Increased Market Share and Customer Base

-

Revenues amounted to 78.3 mEUR in Q3 2023 (Q3 2022: 87.6 mEUR)

- Organic Revenue Growth1 (FX-adjusted) amounted to positive 1%.

- Reported revenue unadjusted for divestments and FX in the amount of 10.2mEUR declined by 11% largely based on discontinued non-strategic games at the end of 2022.

-

Adj. EBITDA2 amounted to 23.1 mEUR in Q3 2023 (Q3 2022: 23.0 mEUR)

- Adj. EBITDA margin increased from 26% to 29%.

- The increase is driven by efficiency gains following the executed cost saving program.

-

Operating Cashflow amounted to 27.8 mEUR in Q3 2023 (Q3 2022: 22.2 mEUR)

- Operating Cashflow increased by 25% year-over year.

- Cash increased to 110.4 mEUR compared to 107.6 mEUR as of June 30, 2023 despite earn-out payments and bond buybacks driven by the strong free cashflow generation.

-

MGI was able to notably increase its market share and its customer base

- MGI continued to gain market share and now holds the #1 position on Android and iOS in the U.S. with a market share of 11% and 28%, respectively."

Se analytiker Anton D’s senaste intervju med MGI’s vd Remco Westermann i början av dec.

MGI kommer att offentliggöra sin Q4-resultat på torsdag och här är analytikerns kommentarer om det. ![]()

MGI will publish its Q4 results on Thursday morning. We expect revenues and operating profit to align with the company’s guidance. Any guidance and/or comments regarding 2024 will be of particular interest in the report. After a year in which the entire industry was weighed down by weakness in ad pricing, we cautiously expect growth to return in 2024 as demand begins to recover.

Här är analytikerns kommentarer om det senaste resultatet. ![]()

MGI reported its Q4 2023 result this morning. Revenues for the quarter were markedly higher than expected, beating the company’s guidance by 6%. Adjusted operating profit (EBIT) came in higher than the consensus estimate, but the margin decreased somewhat. MGI expects strong revenue growth in 2024 as they are beginning to see a recovery of the ad market. The outlook for 2024 was a positive surprise as we had expected the current year only to bring minor growth.

Ny intervju ute där analytiker Anton får frågor om MGIs Q4 rapport: En rapport som slog hans förväntningar.

MGI:s organiska tillväxttakt når 25% i februari 2024. ![]()

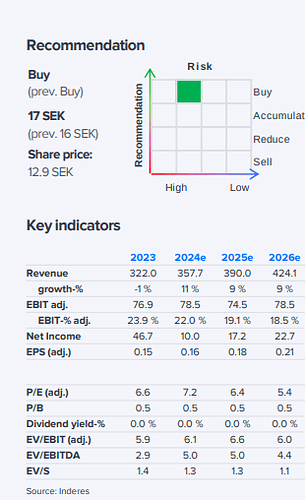

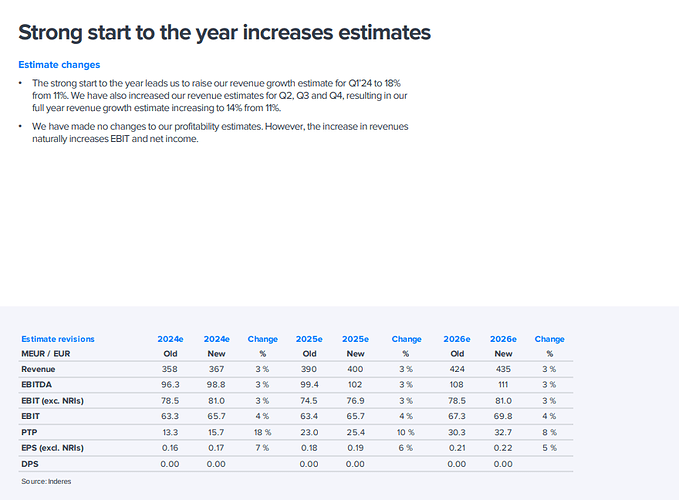

Yesterday, MGI announced that its organic growth rate continued its impressive trajectory, increasing to 25% in February 2024. This follows an earlier announcement of an 18% organic growth rate in January 2024. The continued robust organic growth rate further sets up the start of the year and puts upward pressure on our near-term revenue estimates.

Om företaget är av intresse, bör du definitivt läsa denna färska analys. ![]()

Yesterday, MGI announced that its organic growth rate has increased to 25% in February 2024. This follows an earlier announcement of an 18% organic growth rate in January 2024. The robust organic growth rate is a strong start to the year and leads us to raise our revenue estimates. As the outlook continues to improve, we believe the risk-to-reward ratio remains very attractive.

[quote=“Thiebault, post:220, topic:25772, full:true”]

M8G:n orgaaninen kasvu oli tammikuussa +18% (josta tiedotettiin jo 29.2.2024 Audiocastissa) ja helmikuussa +25% (josta tiedote eilen), joten oletettavasti myös kilpailijoista löytyy mielenkiintoisia osakkeita, joilla kasvu ja näkymät alkavat parantua vastaavalla vauhdilla. Osa onkin jo noussut pohjilta reippaasti. En ole juurikaan perehtynyt mainosalaan, muuta kuin M8G:n ja Perionin kautta sekä muutamiin muihin treidimielessä (esim PubMatic).

Yleisestihän mainosala ja mainosbudjettien kasvu on ollut talouden piristymistä ennustava indikaattori ja se on myös ensimmäisiä aloja, jotka kyykkäävät rajusti hyvissä ajoin ennen taantumaa. Korkojen lasku olisi tietysti hyvä lisäbuusti koko sektorille (mm. velanhoito ja asiakkaiden mainostamisinnokkuuden lisääntyminen)

Ohessa verrokkeja Media and Games Invest:lle (ja muita alaan liittyviä firmoja)

![]()

Audiocast 29.2.2024

cetti1:

@Thiebault tuossa heitti mielestäni hyvän kommentin että mainosalalla nähdään talouden vilkastuminen ensimmäisenä. Tai ainakin itsestäni tuntuu siltä kun muualla vielä kaivetaan muistomerkkejä maahan ![]()

Anton on poistunut joten kysymys heitetään @christoffer.jennel heittää tarkempaa kommenttia asiasta tai omaa näkemystä yleisesti mainosalasta. Nousu ja laskumarkkinassa.

Geologiaopiskelija:

Kuinkahan hyvin Adverty mahtaisi sopia MGI:lle yritysostokohteeksi, kun molempiin kai liittyy mainostoiminta+pelit ja yhtiö sopivan pieni kooltaan ![]() . Vai ovatko suoria kilpailijoita @christoffer.jennel , en ole niin tarkkaan selvillä kun ei teknologia termistö ole omaa erityisosaamista. Tullut seurattua kyseistä yhtiötä pienellä positiolla, teki viime kvartaalilla jo positiivisen tuloksen isoilla kasvuprosenteilla, mutta arvostus mielestäni melko alhainen, mikäli uusia kuoppia ei tule matkaan.

. Vai ovatko suoria kilpailijoita @christoffer.jennel , en ole niin tarkkaan selvillä kun ei teknologia termistö ole omaa erityisosaamista. Tullut seurattua kyseistä yhtiötä pienellä positiolla, teki viime kvartaalilla jo positiivisen tuloksen isoilla kasvuprosenteilla, mutta arvostus mielestäni melko alhainen, mikäli uusia kuoppia ei tule matkaan.

cetti1:

Tässä nyt heitän ikävästi kysymyket omalla kotimaallani, koska ruotsin kieli minulta ei liusta ja tässä on jo pari muutakin kysymystä muilta Suomen foorumin puolelta ![]()

Hi @cetti1 and thank you for your question!

Yes, overall economic health indeed plays a significant role within the advertising market. Marketing budgets are often among the first to be cut during times of uncertainty and economic downturns, as companies tighten their belts and prioritize core expenses. Conversely, when economic signals become more positive and confidence increases, marketing budgets tend to recover swiftly as businesses seek to capitalize on improved consumer sentiment and spending habits.

As stated in the company’s financial reports and press releases, MGI has seen signs of recovery in the advertising market, which has become evident given the strong organic figures that the company has shown between Q4’23 to February 2024. While it may be premature to definitively label this uptick as the onset of sustained market improvement, the conditions for a stronger advertising sector are increasingly promising, particularly given the occurrence of several cyclical events such as the U.S. elections, the Summer Olympics, and the European Football Championship slated for 2024. However, it will be important to monitor e.g. the GDP-development and interest rate trajectory during the year as they exert a significant influence on the overall advertising landscape. Persistent inflationary pressures, coupled with softer U.S. GDP growth in Q1’24, and the resilient U.S. labor market, do present potential risks to anticipated interest rate adjustments in the near future.

First, it is always hard to speculate on future acquisitions. However, regarding Adverty as a potential acquisition target, I would say that it does make some sort of sense given the similarities in the product offerings among the companies and the addressable market. Both Adverty and MGI are involved in digital advertising and gaming, and acquiring Adverty could potentially complement MGI’s existing portfolio. However, it’s worth noting that MGI already holds a strong position within In-App advertising.

In light of this, I believe it is more likely that MGI would prioritize acquisitions that enhance its relationships with advertisers and consumers, particularly in areas such as Demand-Side Platforms (DSPs) to bolster its advertising technology capabilities. This is also something that the company has highlighted as a focus point.

Furthermore, MGI’s focus on reducing debt levels and securing long-term financing suggests that acquisitions may not be prioritized in the immediate future. Instead, the company is likely to continue to focus on generating cash flow and strengthening its financial position before considering additional acquisitions.

MGI kommer att offentliggöra resultatet för första kvartalet på tisdag morgon (7 maj) kl. 8.00 CEST, vilket är en framflyttning från det tidigare meddelade datumet den 30 maj. Vi förväntar oss att den starka organiska tillväxten som uppnåddes under Q4 (16%) kommer att öka ytterligare under Q1, med stöd av den starka försäljningsutveckling som observerades i januari (18%) och februari (25%).

Läs hela analytikerkommentaren här:

Media and Games Invest SE rapporterar rekordhöga intäkter och EBITDA drivet av stark organisk tillväxt på 21% under Q1 2024 - publicerar guidning för helåret 2024.

Hej! Vi släppte nyligen en uppdaterad analys på MGI efter bolagets Q1-rapport, se nedan. Vill du veta mer om bolaget eller har frågor om analysen så svarar jag gärna på frågor här i forumet.

Esityslista tulevaa yhtiökokousta varten:

Firman nimi ainakin esitetään muutettavan Verve Groupiksi mutta mikä omaan silmään osui niin onko mahdollista, että pelipuoli voitaisiin myydä? Mitä mietteitä herättää analyytikolla @christoffer.jennel

Muuten esityksessä oli aika perus asioita ehdolla.

Edit. Käännetty murresanat ymmärrettävämpään muotoon

Hi @cetti1 and thank you for your question!

MGI has, on multiple occasions, emphasized the importance of its games portfolio as it provides the company with first-party data and a unique advertising inventory. Leveraging this first-party data empowers MGI to not only enhance targeting precision but also expedite the testing phase for new services. Furthermore, in a shifting landscape where identifiers are diminishing, access to first-party data becomes increasingly critical. Thus, the likelihood of selling the gaming division appears low, particularly in the near future.

Analytikervideo ute nu:

Välkomna att ställa frågor här på forumet! ![]()

Is there coming eng sub for this video?