Hi here is our recent analysis on Tokmanni translated today! That video you shared we did already in the spring. But we mentioned about Dollarstore already then as we were telling tha the Tokmanni concept is kind of similar than Dollarstore In Sweden.

Hi!

The video I posted was already in this thread, so I posted it unnecessarily. I thought I removed it shortly after posting, but apparently it was still visible after removal (?). It was already a bit old.

The results looked good to me for Tokmanni, but I’m more interested in the future prospects and Dollarstore.

Great analysis, it helped me grasp a better understanding of Tokmanni’s potential future and the impact of Dollarstore. ![]()

Thanks, we are planning to do another video with Isa this week! We will link it also here ![]()

Ja, vi planerar en ny video i veckan! Något särskilt ni vill veta ![]() ?

?

Den föregående videon fungerar bra som recap - faktum är att vi funderade på tillväxten redan då: varifrån skall den komma, då den inhemska marknaden redan är fylld med butiker osv ![]()

Faktum är att även Dollar store förmodligen nämns i videon (not 100 på detta), men vi bollade tillsammans om vi borde rubriksätta “A dollarstore on discount” (iom att man allmänt brukar hänvisa till denna typ av lågprisvarukedja som “dollarstore”. Men vi avstod, då iom att vi ville undvika missförstånd (det finns ju redan en kedja som heter så… funderade vi). Tänk så det kan gå ![]() ! Från inhemskt till nordiskt: undrar om det kommer att ske ngt på namnfronten

! Från inhemskt till nordiskt: undrar om det kommer att ske ngt på namnfronten ![]() ?

?

Tokmanni kan vara lite svårt att ta till sig andra länder än FIN, som redan konstaterats … ![]()

Det här är inte nödvändigt att behandla på videon men jag undrar vilken inverkan skohandeln har på bruttomarginalen? Om jag kommer rätt ihåg så borde clickshoes ha ganska dyra brand som Rieker och Bugatti. (Dyra jämfört med andra tokmannis priser). Omsättning för clickshoes var bara 10milj€ i slutet av år 2021 så inverkan torde inte vara så stor?

Finns det dessutom möjligheter/intresse att föra Clickshoes till Sverige? De får ju nu redan lager utrymme i Sverige. Ledningen verkade mycket nöjd i Clickshoes utveckling och lovade nyheter under hösten…

Bra fråga! Jag har faktiskt tänkt i liknande banor. Rieker, som varumärke är allt annat än obrandat lågvarupris. Samma tanker gällande helheten: åt vilket håll utveckla?

Isa och Olli och Tokmanni (& DollariStore) ![]()

“Tokmanni’s Q2 results were close to our expectations, and we finally saw positive development in comparable EBIT. Inflation continues to a burden on the company, especially in own costs, but we expect the sales margin to continue to recover, supporting the earnings growth outlook. DollarStore acquisition is promising for the future and opens new growth opportunities. Analyst Olli Vilppo comments on second quarter highlights and outlook.”

Thank you @Isa_Hudd and @olli.vilppo1 for discussing about ClickShoes and Tokmanni in general! I didn´t know that they´ve already run a pilot in Porvoo.

It was also interesting to learn more about DollarStore. With the help of Tokmannis purchasing capabilities, I start to see where the synergies and potential is. Do you think that this could have a bigger impact on DollarStores EBIT margins? At least the the Ceo seemed confident that the EBIT margin could be improved? But is it through lower purchasing prices, or other synergies?

Are you familiar with the competition landscape in Sweden, which chains are the top competitors for DollarStore? Rusta and Jula has come to Finland, but any others that one should keep an eye on in Sweden?

Hi

We think that the 15 MEUR synergy potential is realistic and the major part of it should be visible in Dollarstore figure. Off course Tokmanni’s purchases and logistics will benefit for bigger volumes too.

Tokmanni’s Direct sourcing office will help Dollarstore to get more private labels and directly from Asia not through wholesale partner.

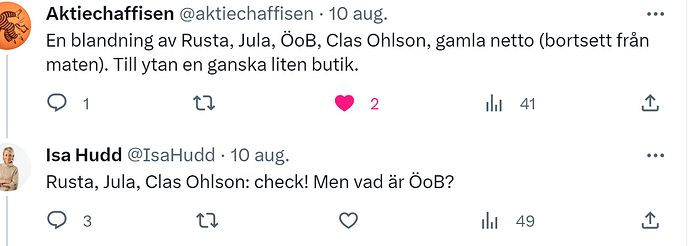

About the competitive landscape we have not yet made an extensive study. But atleast Rusta, Jula, Biltema, Class Ohlson and Öob come into mind. Costco is also interesting as they just came to Sweden, Also I guess Ica is selling also durable goods like Kesko does in Finland even though they are not discount store. I think the Tokmanni management told at some ponit that swedish discount retail market is a growth market like in Finland and I got assumption also that it is bigger market than in Finland but not twice as big like the markets in Sweden usually are as there is double amount of inhabitants. I think Tokmanni will have CMD soon where they will dig into the swedish market.

Thank you Olli for your answer. It’s going to be a very interesting CMD!

Detta ett inlägg jag borde ha gjort för länge sedan, men har helt enkelt inte hunnit! Precis som @olli.vilppo1 skrev så omfattande om bolagets största konkurrenter, så gav de kloka Twitter-anvndarna även samma svar ![]() ! Obs: har kontrollerat med skribenten att detta är ok att klippa in i sammanhanget :)!!

! Obs: har kontrollerat med skribenten att detta är ok att klippa in i sammanhanget :)!!

ÖoB finns på flera ställen i Stockholm o min tanke var att besöka butiken senast jag var i Stockholm, men hann aldrig så långt (många, långa o fullspäckade dagar den gången!). Åker nästa gång i sept o hoppas hinna då.

DollarStore ligger utanför centrum, o jobbar på att få skjuts dit i ngt skede under hösten (ja-såhär töntig är man… , men lite kul med ett finsk-svenskt giftemål (inklusive lite Danmark på köpet, som @Dividendseglaren lyfte fram ![]() …

…

Personligen funderar jag på Normal och ex. Biltema som konkurrenter även på sitt sätt.

Biltema var ngt som också lyftes fram i twitterflödet. Liksom det att Öob kör gratis kaffe till alla kunder en gång i veckan. Ett tvärsäkert kort att locka kunder - precis samma strategi som TOKMANNI kör i Fin: dvs delar ut gratis hinkar : ) som folk köar in långa rader för att få ![]()

Hur som haver: äger ej, dvs Tokmanni, men def. kul att följa utvecklingen framöver!

Intressant på ämnet! RUSTA rustar för börsnotering skriver DI! (Direktlänk till artikeln, som kräver inlogg), nedan:

Av alla ovan uppräknade (har, som sagt ännu ej besökt en DollarStore) är Rusta min absoluta personliga favorit :)! Om siffrorna vet jag inte mkt (ännu), men det händer i sektorn! Kul!!

Det här kan vara intressant för investerare som läser den här tråden. ![]()

Hej alla / Hi all forumers!

(ENGLISH BELOW)

Tokmanni, en ledande lågpriskedja i Finland, har släppt sitt första resultat som en nordisk lågprisaktör. Förvärvet av Dollarstore har lyft Tokmanni-koncernen till en ny nivå. Integrationen av Dollarstore har börjat väl och koncernen förväntas njuta av synergier på över 15 miljoner euro under de kommande > 12 månaderna, med de första större som ska förverkligas den 1 januari 2024.

Resultatet föll kortare än våra förväntningar på grund av lägre än väntade försäljningssiffror i Finland och högre fasta kostnader. Tokmanni upplevde vissa problem med sina digitala marknadsföringsinitiativ bland sina Club-medlemmar i Finland. Dessutom band integreringen av Dollarstore ytterligare resurser vilket kan ha varit en faktor som påverkade den förhållandevis låga jämförbara tillväxten i Finland. Konkurrenterna var också mycket aktiva med pris kampanjer som fokuserade på några av Tokmannis kärnproduktkategorier. Dollarstores tillväxt var anständig men resultatet var svagt.

Enligt vår uppfattning är de huvudsakliga tillväxtdrivkrafterna för de närmaste åren expansionen av Dollarstores butiksnätverk, stabil tillväxt i Finland med jämförbar tillväxt (LFL) och nätverksexpansion, förbättring av bruttomarginaler med egna märken och direkt inköp, samt effektivisering av Dollarstores effektivitet i termer av försäljning/kvadratmeter och kostnader.

Nuvarande värdering är ganska måttlig. Med stark inkomsttillväxt och en anständig utdelningsavkastning förväntar vi oss att den totala avkastningen för aktieägarna (TSR) kommer att vara på en attraktiv nivå.

//

Tokmanni, a leading discount retailer in Finland, released its first result as a Nordic discount retailer. Acquisition of Dollarstore lifted Tokmanni Group to another level. Dollarstore integration has started well, and the group is expected to enjoy over 15 MEUR synergies in the coming > 12 months, first major ones to materialize 1st of January 2024.

The result fell short of our expectations due to lower-than-expected sales in Finland and higher fixed costs. Tokmanni experienced some issues with its digital marketing initiations among its Club members in Finland. Also, Dollarstore integration tied some additional resources which might be a thing that affected quite low like-for-like growth in Finland. In addition, competitors were very active in price campaigns that focused on some of Tokmanni’s core product categories. Dollarstore growth was decent, but the result was soft.

In our view, the next few years main growth drivers are an expansion of store network of Dollarstore, stable growth in Finland with LFL growth and network expansion, improving gross margins with private labels and direct sourcing, as well as improving Dollarstore’s efficiency in terms of sales/squaremeter and costs.

Current valuation is quite moderate. With strong earnings growth and decent dividend yield, we expect the total share holder return (TSR) to be on an attractive level.

Det här borde intressera de som är intresserade av Tokmanni.

In this review, we look at the profitability trends and drivers of the largest Nordic discount retailers over a longer period. The review includes listed Finnish companies Puuilo and Tokmanni, Norwegian Europris and Swedish Rusta and Clas Ohlson.

Hej, väl medveten om att jag verkar framstå som en Rusta-entusiast ![]() , men tipsar om denna sändning som går av stapeln på onsdag.

, men tipsar om denna sändning som går av stapeln på onsdag.

Dvs Rusta Webcast with teleconference, Q2, 2023

Talare: CFO Sofie Malmunger, CEO Göran Westerberg

Detta kan vara av intresse för ägarna till Tokmann. ![]()

I made some notes about the CMD of Tokmanni. Could be useful to share these here. I would appreciate If someone could tell more local insights about DollarStore.

The company’s management seemed to be very enthusiastic about what’s to come, especially DollarStore CEO Anders Kind.

Strong growth and low prices were highlighted in almost all presentations. In addition, the importance of wide variety of products and private labels.

Here are a few quotes from Janne Pihkala’s market review.

- ”Variety discount retailing is the fastest growing physical channel today and will be in the future. Is not my opinion, it is the opinion of independent research companies.”

- ”Whoever has the lowest prices will grow.”

- ”Nowadays, we see a market, where everybody wants to be a discounter. Everybody says that, hey, we have the lowest prices. So what this means is that variety discount retailers, who need to own the price actually need to really force to have the lowest prices in every product they want to compete with.”

- ”One of the key reasons that we Tokmanni are able to gain market shares through expanding our assortments in selected categories.”

CEO Mika Rautiainen focus was on growth strategy and Dollarstore.

- ”Acquisitions have been a very central part of Tokmanni Group’s growth history. During the last 20 years, it’s almost 20 acquisitions that we’ve been doing in Finland. And basically it means that Tokmanni Group has been consolidating the Finnish discounter market quite a lot.”

- ”Tokmanni can operate any retail space between 200 square meters up to 10,000 square meters and even bigger stores profitably. And also when it comes to the location, we are doing profitable business in – whether it’s in the center of Helsinki, where the very city center actually or whether it’s like a shopping mall in small towns, or even a store in small villages like Pihtipudas with population of 3,800. And we’re able to basically operate profitably in all these locations.”

- ”Dollarstore, we have a lot of similarities, which basically means that we’re able to get a lot of synergies with buying and sourcing. We will be sharing a little bit more information about the synergies in our fourth quarter report in the end of March. But already now, I can say that the synergies looks very, very promising. And it’s not only synergies, it’s also about the sharing best practices.”

- ”We constantly screen markets for new potential acquisitions in Northern Europe. – ”You could say that the international growth story has just begun.”

- ”We know exactly where these 220 stores are being located. At the moment, in Finland, the higher interest is doing the real estate investing a little bit slow.”

DollarStore’s CEO Anders Kind was very keen.

- ”Dollarstore is a rough diamond, that we can do everything better.” (Toistaiseksi ei kanta-asiakasohjelmaa, kilpailijoita vähemmän mainostamista ja asiakkaiden aktivointia.)

- ”We think that ourselves, that we have a big huge potential still in Sweden. We think that we can grow quite much in Sweden, but of course, Denmark.” – ”We will definitely continue in Sweden and Denmark, and we’re discussing should we go somewhere else.”

- ”If you look on the one that’s having problems on the market today, it’s the one that customer doesn’t know what to expect from them.” (DollarStore’s concept is crystal clear.

The average sales of Tokmann and Dollarstore stores are quite different. DollarStore sells a significant amount of lower priced products. Some notes about that from the Q&A-session.

- ”On average, Tokmanni store has maybe EUR6 million of net sales per year and DollarStore has around EUR3 million.”

- ”There’s a big opportunity there to increase the, let’s say, sales per store in DollarStore with the, let’s say, bring some of the Tokmanni range into DollarStore.”

- ”If you go to a DollarStore, you will find a lot of products with SEK10, SEK20, or SEK30, meaning like it’s like $0.89, $1.70, and things like this. It’s like very, very cheap products, very good, very affordable products. If I compare to Tokmanni, we’re selling actually more high-ticket products, which of course, also affects the revenue for a store.”

- ”If you’re selling like products with very low ticket, of course, it’s difficult to get like EUR6 million revenues per store, but you have to bring like new assortment as well. This is a huge opportunity. But of course, at the same time, DollarStore cannot lose this reputation of extremely low prices.”

All essential information from the CMD can be founded here: Capital Markets Day 2024 – Tokmanni