Here is a very comprehensive, truly easy-to-read overview of a highly attractive company… LeadDesk. ![]()

(I own shares in this company! ![]() )

)

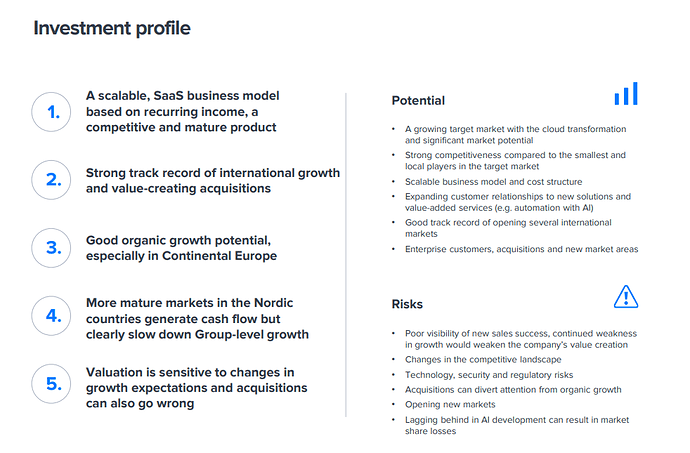

In recent years, LeadDesk’s growth has suffered from the maturing of the Nordic market and the economic downturn, as growth investments have geared more toward the growth markets of Continental Europe. The company has also managed to keep up with the AI transformation in its market. With the Zissonacquisition in December, the earnings potential will begin to surface and the earnings-based valuation (EV/EBITA 2025-26: 13-9x) starts to offer stronger share price drivers. We raise our target price to EUR 8.5 (was EUR 8.0) and recommendation to Buy (was Accumulate).