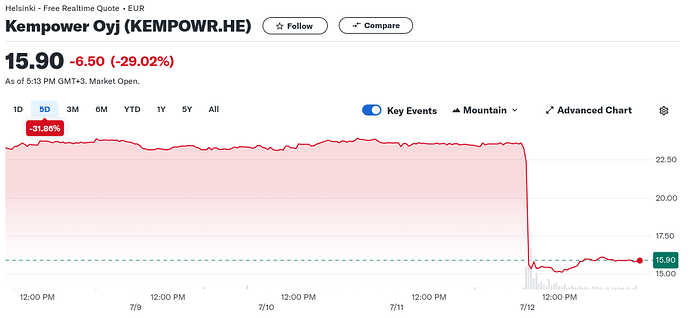

Bad news, and Kempower’s stock is plummeting at a rapid pace - is the stock still expensive… or is it now cheap? ![]()

Customer demand clearly weakening more than expected is turning this year’s result negative and pushing achieving reasonable earnings-based valuation levels toward the end of the decade. The electrification of transport and the high competitiveness of the company’s products still enable value creation in the medium term. However, low visibility to growth in the next few years decreases the risk/reward ratio to negative, thus we lower our recommendation to Reduce (was Buy) and the target price to EUR 19 (was EUR 28).