Jag postade redan denna i en annan kedja, men värt att nämnas även här! I en artikel av David Flatbacke-Karlsson för Unga Aktiesparare, lyfter

Nordea förvaltaren fram 3 bolag på Helsingforsbörsen, där Kempower är ett av dem:

I think it’s perfectly fine if a company makes significant investments for the future and profitability temporarily declines. However, I wonder how the company will manage to maintain a good level of profitability as competition intensifies and competitors evolve. How will the company succeed in the global market in the future? Even after this drop in stock price, can it still be considered cheap? ![]()

That’s a very interesting question! From a competition perspective, I believe the market will concentrate among the top players, such as Tesla, Alpitronic and Kempower. There’s significant barriers to entry in this market why some companies will be left behind and only relatively small number of companies will dominate the market (compared to AC charging where there’s high number of players).

Margin levels could of course suffer along with shifts in demand. If the electrification of transportation slows down, that could force competitors to sell products for lower prices and weaker margins to fill their utilisation rates. However, there’s a limit to this coming from the profitability of charging manufacturers. Most are still unprofitable so they might not be able to push prices down too much. Kempower is probably the most profitable company in the industry with a differing product offering and is therefore favourably positioned to a potential price war.

Looking to the valuation, the stock is expensive with current earnings. One should take into account that the current earnings suffer from 2 large factory investments (US and Lahti2) which do not yet generate material revenue. If the sales growth guided by the company starts to materialize in H2 2024, that would mean rapid earnings growth and value-generation in the coming years. Looking to risks to this scenario, a weak market demand is the most likely one. I do not expect Kempower’s product-related advantages to vanish anytime soon.

Thank you for your excellent and comprehensive responses! ![]()

I’m satisfied with your answers. Sometimes I’ve thought that Tesla will quickly dominate, especially with other automotive companies that can do anything with their incredible resources. Well… “the others” would have already joined in if it were easy and particularly profitable for them.

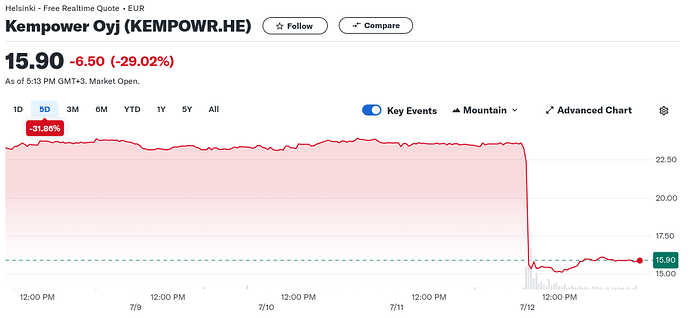

Kempower’s stock has plummeted a lot… just too much or totally justified? ![]()

Anyway… many expect this company’s mega success to continue.

The beginning of the year was challenging for Kempower, partly due to high customer inventory levels and delayed decision-making. However, the company expects the situation to improve during the latter part of the year. Kempower’s CEO Tomi Ristimäki comments in an interview with analyst Pauli Lohi.

Content:

00:00 Intro

00:22 Challenging quarter

01:14 Guidance

02:06 Product portfolio

02:32 Market drivers

04:01 Charging infrastructure for utility vehicles

05:10 Competitive landscape

Bad news, and Kempower’s stock is plummeting at a rapid pace - is the stock still expensive… or is it now cheap? ![]()

Customer demand clearly weakening more than expected is turning this year’s result negative and pushing achieving reasonable earnings-based valuation levels toward the end of the decade. The electrification of transport and the high competitiveness of the company’s products still enable value creation in the medium term. However, low visibility to growth in the next few years decreases the risk/reward ratio to negative, thus we lower our recommendation to Reduce (was Buy) and the target price to EUR 19 (was EUR 28).

Kempower - Friend or Foe? ![]()

Kempower will announce its Q2 interim results on Wednesday, July 24 at around 9.30 am EEST. Weak sales and low order intake have been known since the company issued a profit warning on July 11. On this basis, we expect the most important information in Q2 to relate to the possible details behind the decline in sales and the company’s future measures to turn around the result and increase sales.

Many have considered Kempower to be Finland’s upcoming mega company, but recently, it has faced significant difficulties relative to expectations.

An analyst from Inderes interviewed Kempower’s CEO.

Kempower, which issued a profit warning, suffers from a difficult market situation as customers digest their high inventory levels, which were temporarily increased due to the post-pandemic component shortage creating unusually high demand. To defend profitability and cash flow, Kempower aims for significant cost savings in the short to medium term. Kempower’s CEO Tomi Ristimäki commented on the challenging start of the year in an interview with analyst Pauli Lohi.

Topics:

00:00 Introduction 00:13 Difficult quarter 01:09 Outlook for the end of the year 01:44 Significant new customers 02:30 Progress in the United States 03:14 Price competition in the market 04:14 Decline in sales margin 04:42 Cost-saving measures

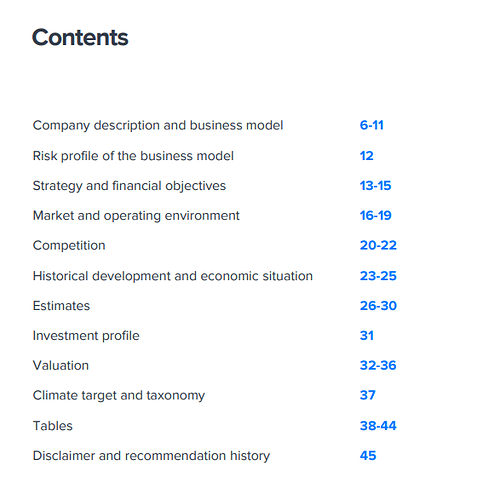

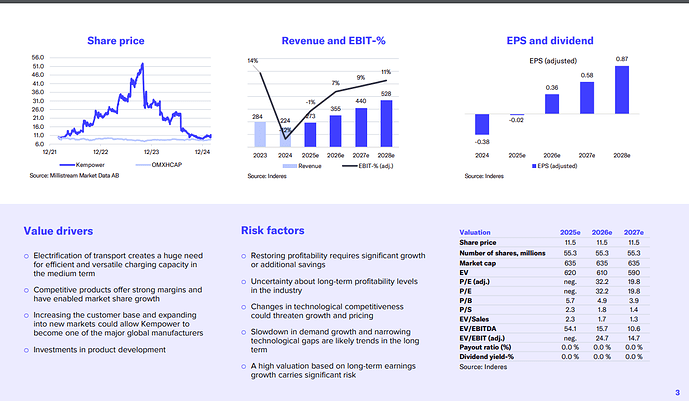

Here is a fresh and high-quality analysis of a potential future success or failure. ![]()

The demand challenges seen in the charging market stem from over-investment by charging operators in 2022-23. We expect that lower customer inventory levels and the acquisition of new customers will turn Kempower’s sales into growth in 2025, with a clear turnaround in profitability. We find the long-term growth of the target market and the competitive value creation potential of Kempower’s products as attractive at the current share price. We raise our recommendation to Accumulate (previously Reduce) but reduce our target price to EUR 16 (previously EUR 19), due to the increase in the required return, among other factors.

There have been a lot of various negative news related to Kempower lately. The stock price is dropping and has dropped significantly.

Here are an analyst’s comments on the recent news.

Kempower completed its redundancy negotiations, and the actual headcount reduction was largely in line with expectations. We believe a profitability turnaround is possible in 2025, but this will require the company to achieve success on the sales front in addition to savings. In the short term, we see significant uncertainty about order growth and market demand.

Kempower har nyligen lanserat nästa generations laddningslösningar, som utgör en betydande förbättring jämfört med tidigare produkter. Prestandan hos dessa nya produkter är tydligt konkurrenskraftig, särskilt när det gäller effektfaktorer. Detta innebär att Kempowers laddstationer kan utnyttja elnätet mer effektivt, vilket kan hjälpa kunder att spara energi- och laddningskostnader. ![]()

Förutom de nya produkterna har Kempower även lyckats särskilja sig på marknaden med sina satellitbaserade laddningssystem, som kan ladda upp till åtta bilar samtidigt. Detta ger laddningsoperatörer möjlighet att bygga stora laddningsfält kostnadseffektivt.

Även om försäljningen av elbilar nyligen har ökat långsammare än förutspått, stödjer långsiktiga trender elektrifieringen av transportsektorn. Utvecklingen av batteriteknologin för elbilar och sjunkande kostnader gör dem alltmer attraktiva. Dessutom driver strängare miljölagstiftning, särskilt i EU och USA, bilproducenter mot helt elektriska lösningar.

Sammanfattningsvis positionerar Kempowers nya produktportfölj och laddningslösningar företaget starkt på den växande marknaden för elektrisk trafik.

Jag hittade inte den här nyheten själv, men det är säkert något som också intresserar investerare. ![]()

Alpitronic är en ny aktör i USA, men de har redan ingått ett avtal med Mercedes-Benz. Mercedes planerar att investera en miljard dollar (i första fasen) för att bygga sitt eget laddningsnätverk i USA. Målet är att bygga 400 laddningsstationer till år 2027, och laddaren som valts är Alpitronics HYC400-modell.

Det verkar som att Alpitronic redan med sitt första avtal har kommit upp jämsides med Kempower och kanske till och med gått förbi dem.

Here is the best analysis, very comprehensive and high-quality. It’s worth reading about this “Tesla of Finland.” ![]()

Kempower has rapidly grown its market share in the fast charger market in recent years. However, the current year’s result is turning into a loss, and competition has intensified, partly due to a temporary weakening of market demand. The key to the investment story would be for Kempower to be able to strengthen its market position in the coming years without a significant decline in margins. For the time being, the uncertainty of the outlook and the difficulty of predicting the competitive situation weigh on the risk/reward ratio. We reiterate our Reduce recommendation and the target price of EUR 10.

Kempower’s Q3 report showed that the expected improvement in order intake has not yet materialized. High customer stock levels weakened demand, and this impact is expected to continue until early 2025. The order intake amounted to EUR 51.5 million, 15% lower than the previous year and 11% below expectations. The company also lowered its full-year revenue guidance to EUR 220–230 million (previously EUR 220–260 million). According to an Inderes analyst, Kempower is expected to return to growth in 2025, but there is considerable uncertainty about the timing of the turnaround.

Has the stock declined enough, or… what?

A more detailed analysis from the Inderes analyst can be found below.

Sara och Pauli pratade mycket om den omtalade Kempower.

Content:

00:00 Intro

00:08 Company’s situation

01:28 Q3

02:00 Inventory levels

03:11 Market situation

04:25 Most important thing in Kempower’s case

05:29 Valuation and recommendation

Här funderar jag bara lite…

Kempowers framgång på Helsingforsbörsen har avtagit när marknadens förväntningar och verkligheten inte möts. Enligt de senaste resultatrapporterna har företagets försäljning minskat och antalet beställningar krympt avsevärt. Orsakerna är både en svagare efterfrågan och att kundernas lager har vuxit i kölvattnet av pandemin.

Även om nuläget ser utmanande ut, tror analytiker på en ljus framtid för elfordon. Särskilt laddlösningar för tung trafik kan erbjuda Kempower en ny tillväxtplattform. När den offentliga laddinfrastrukturen utvecklas och elektrifieringen av tung trafik accelererar kan Kempowers expertis bli en avgörande faktor på framtidens marknader.

Kan Kempower fortfarande ha en chans att stiga kraftigt?

Here’s a brand-new analysis of the company—some once expected it to become a huge success… could it still happen?

Here’s a fresh analysis of the company. ![]()

JA! Mera aktieanakytikersnack till folket! @Pia_Maljanen pratade Kempoer med @pauli.lohi

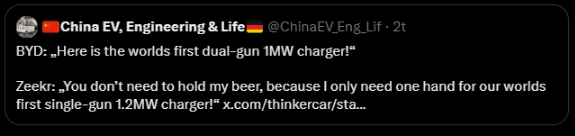

Zeekrs 1,2 MW-laddare visar Kinas snabba utveckling inom laddningsteknik. Ett hot mot Kempowers konkurrensposition på den globala marknaden? ![]()

![]()

The CEO of Kempower, often referred to as “the Tesla of Finland,” was interviewed by an analyst from Inderes. ![]()