Our strategy update for 2023-2027 is now published ahead of the CMD, I’ll share the full release here:

–

Inderes updates its strategy for 2023-2027

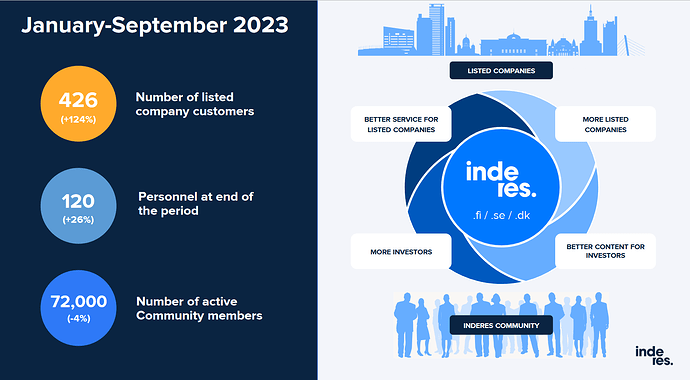

Inderes’ Board of Directors has approved an updated strategy for the period 2023-2027. Since the IPO in 2021, the company has made investments that shift the focus of its strategy towards international growth.

The core idea of Inderes is to democratize Nordic investor information by connecting investors and listed companies. A key trend underpinning this is the increasing transparency and openness of capital markets demanded by investors. Inderes’ products for investors and listed companies are built around the Inderes platform developed by the company. A growing number of listed companies linked to the platform enables better services for investors. The Inderes community of investors strengthens competitive advantages and attracts new listed companies to Inderes products. The strategy will continue to be based around this network effect that supports growth.

For the period 2023-2027, the strategy will focus on four selected main products (Equity Research, IR Events, AGMs, and IR Software) and three selected geographical markets (Sweden, Finland, and Denmark). The company is working towards its objectives through three selected key themes: productization and sales, Sweden, and international Inderes.

The choices are based on the Inderes team’s current assessment of where the company can focus its resources to create the most value for its employees, community, customers, and shareholders. Moreover, the choices focus on market segments where the company already has, or can achieve in the future, a competitive advantage that enables strong profitability.

“At the heart of Inderes is to act as a challenger that reforms the structures of the financial sector. The new strategy will put us back in the position of a challenger in selected target markets that are significantly larger than the Finnish market. Our long-term goal is to do the same that we have done in Finland in the selected countries," says Mikael Rautanen, CEO of Inderes.

Selected products of the strategy

The strategy focuses on four main products, targeting listed companies’ investor communications:

- Equity Research. Independent equity research that serves all investors. Current client base of over 140 listed companies.

- IR Events. Broadcasts of earnings calls, capital markets days and other events as online and hybrid events on Inderes channels. Current client base of over 300 listed companies.

- AGMs. Implementation and software for physical, virtual, or hybrid meetings. Current client base of over 100 listed companies.

- IR Software. Mandatory software solutions required for investor communications. Current client base of over 40 listed companies.

Inderes’ product offering covers all the key solutions required by a listed company for investor communications. The products combine expert work, Inderes’ technology platforms and Inderes’ investor media. During the strategy period, the company will focus its R&D efforts on the further development of these four main products. In addition to the further development of the main products, Inderes will continue to actively pilot new concepts together with the investor community and listed companies. The aim of the products is to make investor communications for listed companies effective, transparent, and investor-friendly.

Inderes has the role of an independent information service in the market and has no plans to expand into the investment banking business.

Selected target markets for the strategy

During the strategy period, Inderes’ primary target market will be Nasdaq-listed companies in Sweden, Finland, and Denmark. Inderes estimates the market potential of its main products in this market to be over EUR 120 million. The target market currently comprises more than 1,100 listed companies, of which more than 400 companies are connected to the Inderes platform through one or more product areas.

The company’s long-term goal is to build the full Inderes operating model in selected markets: a comprehensive product offering for a listed company, Inderes investor media and a local community.

- Sweden will be the company’s main growth market during the strategy period.

- In Finland, the company aims to expand its product offering in its existing client base and actively develop the domestic IPO market.

- In Denmark, Inderes operates through its strategic partner and associate HC Andersen Capital (HCA). HCA operates the inderes.dk investor service locally and aims to introduce the Inderes product range to its listed company clients.

Through the Nordic operating model, Inderes will be able to offer investors more comprehensive content, which will enhance the Free and Premium services offered to investors. Furthermore, listed companies will be able to reach a wider Nordic audience through Inderes, which will improve the service for existing customers. In addition to the selected target markets, the company can pilot other markets with individual products.

Inderes’ competitive advantages and strengths

The strategy builds on the following strengths and competitive advantages, which the company will continue to strengthen during the strategy period:

- Inderes media: Inderes is a unique platform that enables the listed company to reach a wide range of target groups, from private investors to professionals.

- Comprehensive product offering: Inderes is the only service provider that can offer a listed company all the solutions needed to provide quality service to its shareholders.

- Investor-centricity: Inderes was created to serve investors and develops its activities in close cooperation with the investor community.

- Organization: Inderes has built an organization that attracts experts in the field, combining wholeness, agility, creativity, and disciplined execution.

Key strategic themes and identified obstacles

As part of its strategy work, the Inderes team has identified the following obstacles to international growth:

- Low awareness of Inderes in markets outside Finland

- Building a product offering and sales models in Sweden

- Developing an international organization culture

- Building investor communities in markets outside Finland

The strategy is guided by three key themes to overcome obstacles and support the company on its way to achieving its goals. The key themes are productization and sales, Sweden, and international Inderes.

The aim of the productization is to make the products Inderes offers to listed companies easier to buy, deliver, and sell. In-house software development strengthens product automation and scalability and frees up resources for growth. The company is strengthening its sales organization and capabilities to support international growth.

The Swedish market will be Inderes’ main growth market during the strategy period. To build awareness among listed companies and the investor community, Inderes will initiate research coverage on selected interesting Swedish companies and pilot other products with free models. Short-term growth will come from the events business, where the company has growth opportunities by replicating proven concepts. The aim is to become a well-known investor media and IR partner for listed companies in Sweden during the strategy period.

Inderes has historically been strongly built around a local operating model and to succeed in international growth, the company needs to build internationalization capabilities. Inderes will continue to actively develop the people-centered culture and co-lead organization model described in its Playbook to support international growth. In the second half of 2023, Inderes will upgrade its technology platform, which is at the core of the operating model, to a modern platform that supports the international operating model. In addition, the company will unify its brand portfolio during the strategy period.

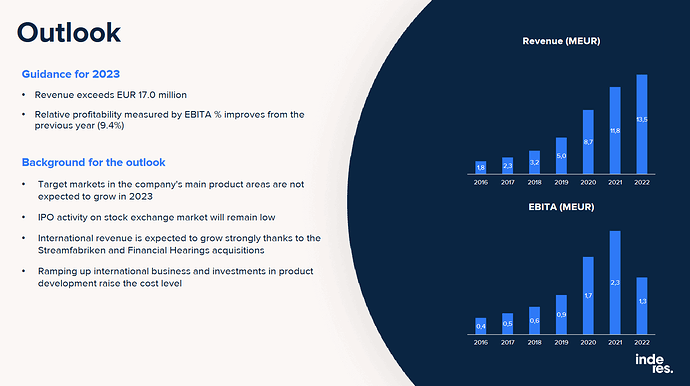

Financial objectives

The long-term economic objective of Inderes is to:

- Financial objective: to maintain a combined revenue growth rate and profitability (EBITA%) of 30-50%

- Payout policy: annually increasing absolute payout, including dividends and share buybacks

In Finland, the company is aiming moderate growth and strong profitability in the strategy period 2023-2027. In Sweden, the focus is on growth. Profitability in Sweden is expected to be break-even or slightly positive in the coming years during the ramp-up phase of the business and to improve towards the end of the period. In Denmark, the company operates on a partner model, where sales are based on HC Andersen Capital’s growth-based license fees.

Acquisitions

During the strategy period, Inderes may evaluate potential acquisition targets to accelerate growth, competitive advantage, or market entry in one or more main product areas. However, acquisitions are not considered necessary for the implementation of the strategy.

In Denmark, Inderes and HC Andersen Capital are evaluating a merger as a strategic option for the long term, provided that certain conditions are met. Inderes currently owns 20% of HCA.

Capital Markets Day May 26, 2023

Inderes will present its updated strategy at the Capital Markets Day on May 26 from 9:30 am to 11:30 am (EEST). You can participate in the event at CMD 2023

![]()

![]()

![]()