Today we can warmly welcome 23 new colleagues to the team!

"Inside information: Inderes accelerates its internationalization by acquiring Financial Hearings and Streamfabriken, the Board of Directors decided on a directed share issue related to the acquisitions

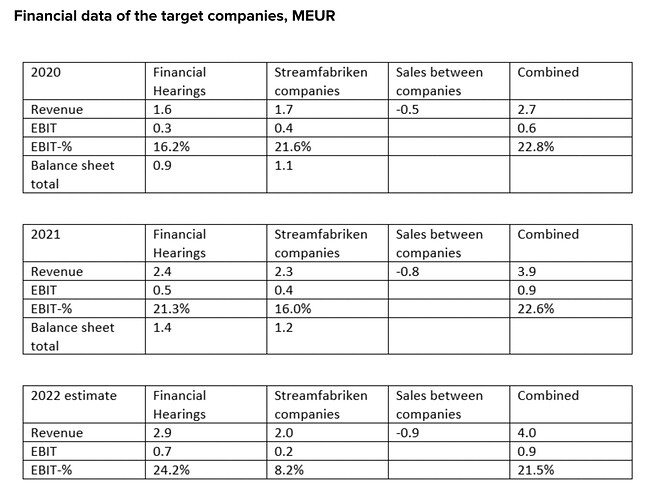

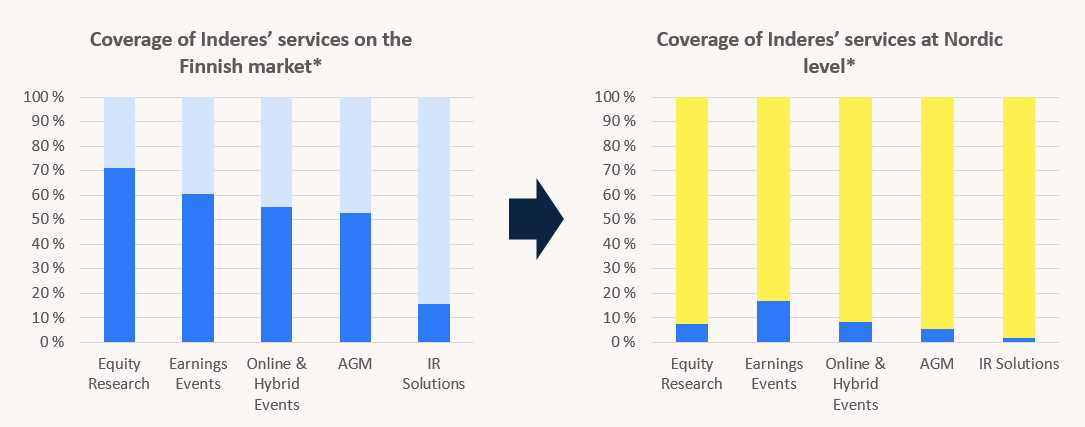

Inderes has today signed an agreement to purchase the entire share capital of Svenska Financial Hearings AB and Streamfabriken AB, Streamfabriken Oy and Streamfabrikken AS. Financial Hearings is the market leader in producing investor relations events in Sweden. Streamfabriken acts as the production company for Financial Hearings and serves other customers in the online events market in Sweden, Finland and Norway. The companies employ 23 people in total. The combined revenue of the acquisition targets including intercompany sales was about EUR 3.9 million and EBIT around EUR 0.9 million in 2021. Both companies are net debt-free. With the acquisitions, Inderes expands its platform to cover over 400 listed companies in the Nordic countries.

Financial Hearings has operated in the Swedish financial sector for 30 years and arranged over 10,000 investor events, which has built a unique contact network and industry knowledge. The company’s customer base consists of over 200 mainly Swedish listed companies that use its services to execute result releases, AGMs and CMDs.

Streamfabriken is a production company specialized in high-quality technical execution of online events that operates in the same location and in close cooperation with Financial Hearings in Sweden. The company also has four employees in Finland and a recently established company in Norway. The companies have been using the Videosync software platform developed by Inderes in their broadcasts for years.

“In Sweden, Financial Hearings and Streamfabriken have done what Inderes and our subsidiary Flik have done in Finland: democratized information by making listed companies’ investor events available to all investors. It is an honor to be able to take these companies forward that have been built over decades with a long-term vision of openly serving investors and listed companies,” said Mikael Rautanen, CEO of Inderes.

“Financial Hearings delivered the first webcast of a Swedish investor event in 2000, which launched a new era in the financial sector. I am proud to be able to transfer Financial Hearings to a new generation of entrepreneurs in the financial sector after working with investor events for 30 years. Inderes shares our vision of a Nordic player and the companies share the same values,” said Per-Erik Holmström, the main owner and founder of Financial Hearings.

“Inderes has shown that it can provide an excellent framework for an online event production company to grow and prosper. With the production teams in Helsinki and Stockholm, own studios and own software platforms, we will be able to serve customers in the most demanding event concepts in the Nordic countries in the future,” said Janne Jaakkola, CEO and founder of Streamfabriken.

Inderes has made an almost corresponding transaction in 2019 when it acquired Flik Media Group. Thus, the company has a strong understanding of the acquisition target. The value creation of the transaction is expected to be based on the following factors:

- Personnel. The employees of Financial Hearings and Streamfabriken will be able to work with a broader service offering internationally as part of a growing business. The internationalization of Inderes opens new career opportunities for the company’s employees.

- Community. After the arrangement, Inderes has a stronger basis for building an Investor Community in Sweden. In addition, after the transaction, Inderes’ platform will have increasing new content on interesting companies.

- Customers. The webcasts of Financial Hearings’ customers will be connected to the Inderes platform in the future, allowing them to reach a wider investor audience. Together, the companies are able to help customers with a wide variety of investor communications needs. Inderes’ current customers will be able to reach wider audiences as the platform expands in the Nordic countries.

- Shareholders. The acquisition has three key value creation mechanisms for owners. Firstly, expanding customer relationships to cover higher value-added studio broadcasts will generate additional sales potential, of which Inderes already has a track record in Finland. Most Financial Hearings’ events are currently based on cost-effective audiocasts. Secondly, the production value of the events can be raised with the software solutions developed by Inderes and external costs can be reduced. Thirdly, Inderes’ extensive service offering that covers key investor communications functions, opens opportunities to provide more comprehensive solutions to the customers.

The structure of the transaction

The total purchase price for the acquisitions is EUR 8.2 million and net debt-free purchase price is EUR 7.3 million. 19% or EUR 1.6 million of the purchase price will be paid in Inderes Oyj shares and the remaining EUR 6.6 million in two cash installments. To pay the purchase price, Inderes Oyj’s Board of Directors resolved based on an authorization from the Extraordinary General Meeting on a directed share issue in which the sellers were offered a total of 48,787 new Inderes’ shares at a subscription price of EUR 31.92 per share. The subscription price was determined based on the volume-weighted average price (VWAP) of Inderes’ shares between June 29 and September 28, 2022. The shares have a 12-month restriction on the right of disposal. The second installment of the cash consideration, i.e. EUR 2.9 million, will be paid within 14 months of the signing the contract, i.e. in February 2024. The transaction does not include an additional purchase price. Inderes financed the transaction with cash, own shares and a bank loan of EUR 2 million.

The number of shares issued in the directed share issue corresponds to approximately 2.99% of all shares in Inderes Oyj before the share issue and approximately 2.90% of all shares after the share issue. As a result of the directed share issue, the total number of shares in Inderes will rise to 1,681,404. The new shares will be registered in the trade register on or about 21 November 2022 and the shares will be trading together with the old shares on the First North Growth Market Finland marketplace maintained by Nasdaq Helsinki Oy on about 22 November 2022.

Both acquisition target companies are owned by their founders and key personnel. Johan Wallinder, CEO of Financial Hearings, and Janne Jaakkola, CEO of Streamfabriken will continue working for Inderes. The founder of Financial Hearings Per-Erik Holmström will independently lead the IR Global League project that focuses on coordinating IR events of listed companies. Peter Sergel continues as the Country Manager of Inderes Sweden. The company’s intention is to keep the Financial Hearings brand for the time being."

![]()