H&M reported its fiscal Q4 (Sep-Nov) this morning:

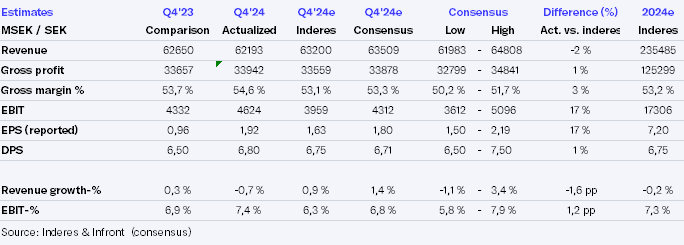

- Sales in local currencies was up 3 %, supported by strong September (which was reported earlier), while Oct-Nov was flattish. In reported terms sales declined slightly. Sales were slightly weaker than forecasts

- Gross margin was surprisingly up 90bp y/y despite cost headwinds and lower prices. Markdowns decreased y/y against earlier comments from company as focus was more on full-price towards end of the quarter. This is most likely reflected partly as lower sales, but also absolute gross profit was slightly ahead of forecasts

- Opex was flat y/y and slightly lower than expected, although opex/sales increased a bit

- This lead to EBIT increasing y/y and being clearly higher than our forecast and also above consensensus

- Dividend was increased to 6,80 SEK from 6,50 SEK, largely as expected

Outlook for Q1’25:

- H&M says that December-January sales were up 4% in local currencies - in line with expectations

- H&M sees external factors being negative and markdowns increasing in Q1, impacting gross margin negatively. We also assume that lower prices will have negative y/y impact.

As usual, H&M does not give financial guidance. For full-year 2025, it expects to close a net of 80 stores, of which a large part is Monki stores as the chain is wound down. The net closure represents some 2 % of total store count and hence store closures continue to have slight negative impact on sales, we believe.

In sum: Better than expected gross margin drove a positive earnings surprise, while other things are pretty much in line with forecasts. We expect a positive share reaction today. Positive estimate revisions might be limited however as they already point to improving margin in 2025 and gross margin strenght might be limited to Q4.