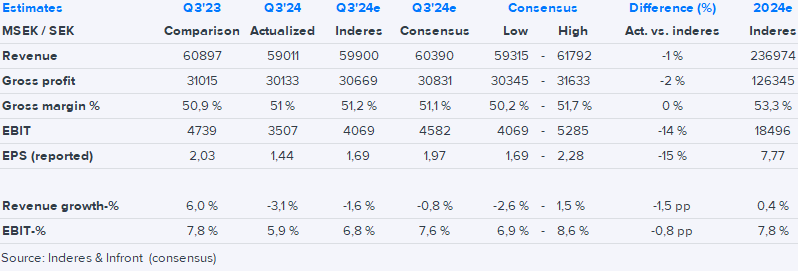

Vi tror att efterfrågan på HM har förblivit trög under Q3, samtidigt som företaget står inför flera motvindar vad gäller bruttomarginalen. Vi förväntar oss att detta kommer att resultera i ett svagare andra halvår än vi tidigare förväntat oss.

H&M redovisar resultatet för Q3’24 (juni-augusti) på torsdag. Vi förväntar oss att omsättningstillväxten blir något positiv i lokala valutor, men negativ i rapporterade termer. Vi förväntar oss att EBIT minskar jämfört med föregående år med en i stort sett stabil bruttomarginal och något högre opex med en negativ försäljningstrend som påverkar resultatet.

Kommentar inför rapporten:

H&M Q2 was released this morning, key points:

- Sales in local currencies were flat, just below our and consensus expectation of +1%, and reported sales declined 3 % also slightly below expectations

- Gross margin was 51,1%, very much in line with expectations and close to comparison period

- EBIT was only 3500 SEK, below all estimates. The company however says that winding down costs for Afound -chain and “long-term” marketing investments" totalled 550 MSEK, but even adjusting for that the earnings would have been below consensus, while inline with our estimate

- Looking forward, H&M expects September sales to be up as much as 11 %, which is clearly positive (we have 4 % for Q4 in total)

- The “external factors” as well as cost of markdowns are expected to have a negative impact to gross margin in Q4, while marketing costs will also be higher than in Q3

- H&M says they estimate this financial year’s EBIT margin to be below their ambition of 10 %, which was well expected already with expectations around 8 %

- So overall very poor Q3 earnings, but partly due to one-offs and very nice sales pick-up in September, while margin pressure seems to continue in Q4

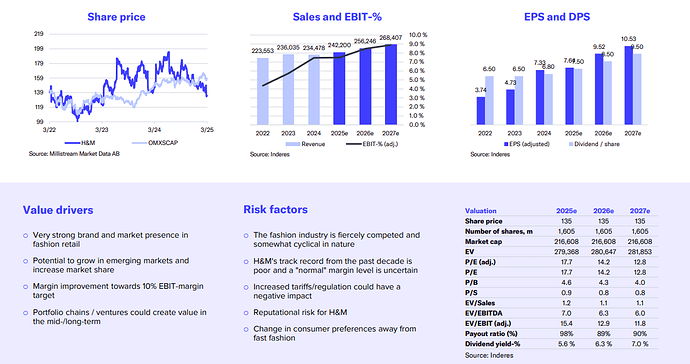

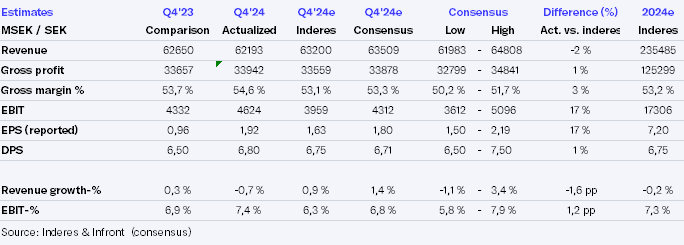

Inderes tror att konsumentefterfrågan under H&M:s fjärde kvartal (september–november) förblev dämpad trots en stark september. Bruttomarginalen försvagades av prisnedgångar, ökade reaaktivitet och högre produktions- och transportkostnader. Företagets effektivitetsprogram hjälper dock till att hålla operativa kostnader under kontroll.

H&M stänger sin Monki-kedja, vilket medför engångskostnader för fjärde kvartalet, men i övrigt förblir kostnaderna hanterbara tack vare en måttlig omsättningstillväxt. Förbättringstakten för marginalerna verkar dock avta, och de långsiktiga lönsamhetsmålen framstår som utmanande. Inderes bedömer att aktien fortfarande är relativt rättvist värderad, eftersom tillväxtutsikterna förblir stabila men begränsade.

H&M will report its Q4’24 (September-November) results on Thursday at 8:00 am CEST. We expect slightly positive revenue growth both in local currencies and reported terms. However, we expect EBIT to decline year-on-year due to a slightly lower gross margin and stable opex/ sales. We expect a positive top line development for the beginning of the fiscal year 2025.

H&M reported its fiscal Q4 (Sep-Nov) this morning:

- Sales in local currencies was up 3 %, supported by strong September (which was reported earlier), while Oct-Nov was flattish. In reported terms sales declined slightly. Sales were slightly weaker than forecasts

- Gross margin was surprisingly up 90bp y/y despite cost headwinds and lower prices. Markdowns decreased y/y against earlier comments from company as focus was more on full-price towards end of the quarter. This is most likely reflected partly as lower sales, but also absolute gross profit was slightly ahead of forecasts

- Opex was flat y/y and slightly lower than expected, although opex/sales increased a bit

- This lead to EBIT increasing y/y and being clearly higher than our forecast and also above consensensus

- Dividend was increased to 6,80 SEK from 6,50 SEK, largely as expected

Outlook for Q1’25:

- H&M says that December-January sales were up 4% in local currencies - in line with expectations

- H&M sees external factors being negative and markdowns increasing in Q1, impacting gross margin negatively. We also assume that lower prices will have negative y/y impact.

As usual, H&M does not give financial guidance. For full-year 2025, it expects to close a net of 80 stores, of which a large part is Monki stores as the chain is wound down. The net closure represents some 2 % of total store count and hence store closures continue to have slight negative impact on sales, we believe.

In sum: Better than expected gross margin drove a positive earnings surprise, while other things are pretty much in line with forecasts. We expect a positive share reaction today. Positive estimate revisions might be limited however as they already point to improving margin in 2025 and gross margin strenght might be limited to Q4.

Analys ute nu efter H&M:s Q4 rapport igår:

Vi ser att vinsttillväxt och utdelning ger en rimlig förväntad avkastning!

USA announced several tariffs over the weekend, including a 10 % tariff for China. As we have highlighted in the latest reports, US is one of H&M largest markets (some 15% of revenue), while China accounts around 25% of its sourcing. Hence, the new tariff will increase costs for the goods shipped from China to US. The magnitude of the impact for the group is however modest give the tariff is only 10 % at least for now. Also, we understand the situation is pretty similar for competitors so the industry is likely to push the increased costs to higher selling prices. This will not happen overnight however, so there’s some margin pressure for H&M in the US in the short term, we believe.

H&M’s expected decline in gross margins and the impact of external factors during the first quarter (December-February) led to a revision of earnings forecasts. However, Inderes still expects sales growth and a good return on dividends.

I H&M:s Q1-rapport var marginalerna lägre än förväntat, men VD Daniel Ervér är optimistisk om en vändning. Analytikern Lucas Mattsson intervjuades av Jesper Hagman. ![]()

Lucas har gjort en ny analys av H&M, jag rekommenderar att läsa den. ![]()

H&M’s Q1 earnings were weaker than expected, and we anticipate continued margin headwinds in Q2. However, we foresee revenue growth and a shift from gross margin headwinds to tailwinds starting in H2’25, leading to continued sales and margin improvements throughout 2026-27. We maintain our view that earnings growth and dividends offer a reasonable expected return and, therefore, reiterate our Accumulate recommendation with a slightly lowered target price of SEK 145 per share (previously SEK 150), reflecting lower short-term estimates.

Det här är absolut läsvärt om man är intresserad av det här bolaget. ![]()

H&M:s utsikter har försämrats på grund av tullar, avmattad ekonomisk tillväxt och ökad osäkerhet. Prognoserna har sänkts, rekommendationen har ändrats till minska och riktkursen har justerats ned till 130 kronor.

Här är den nya analysen av bolaget:

We have updated our short- and medium-term forecasts for H&M in light of the potential tariffs, expectations of slower economic growth and escalating uncertainty. In our view, the short-term multiples reflecting this are not particularly attractive. We therefore change our recommendation to Reduce (was Accumulate) and lower our target price to SEK 130 per share (was SEK 145), mainly due to lowered estimates.