H&M Q2 was released this morning, key points:

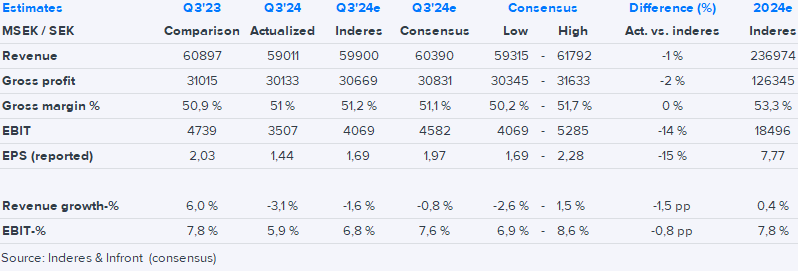

- Sales in local currencies were flat, just below our and consensus expectation of +1%, and reported sales declined 3 % also slightly below expectations

- Gross margin was 51,1%, very much in line with expectations and close to comparison period

- EBIT was only 3500 SEK, below all estimates. The company however says that winding down costs for Afound -chain and “long-term” marketing investments" totalled 550 MSEK, but even adjusting for that the earnings would have been below consensus, while inline with our estimate

- Looking forward, H&M expects September sales to be up as much as 11 %, which is clearly positive (we have 4 % for Q4 in total)

- The “external factors” as well as cost of markdowns are expected to have a negative impact to gross margin in Q4, while marketing costs will also be higher than in Q3

- H&M says they estimate this financial year’s EBIT margin to be below their ambition of 10 %, which was well expected already with expectations around 8 %

- So overall very poor Q3 earnings, but partly due to one-offs and very nice sales pick-up in September, while margin pressure seems to continue in Q4