En ny analys av företaget har publicerats av Lucas Mattsson. ![]()

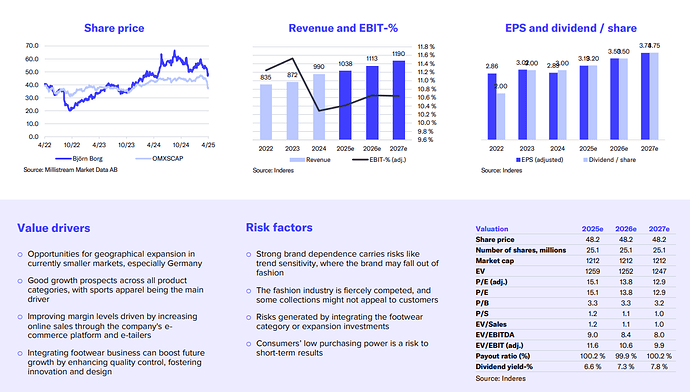

We have lowered our estimates in response to expectations of slower economic growth and weaker consumer confidence. Despite these downward revisions the current valuation offers an attractive risk/reward profile, as the share price has fallen by around -17% and the expected return exceeds our required return. Consequently, we raise our recommendation to Accumulate (prev. Reduce) but lower our target price to SEK 55 per share (prev. SEK 62), mainly due to lower estimates.