Valmet utfärdade en negativ resultatvarning, vilket var överraskande eftersom företaget fortfarande i juni hade höjt sin resultatprognos. Omsättningsprognosen förblir oförändrad, men resultatet förväntas inte längre öka.

Marknaden för tjänster har utvecklats långsammare än förväntat, särskilt i EMEA-regionen och Asien, och efterfrågan på kartong- och pappersteknologier har varit svag. Dessutom har vissa kunder skjutit upp sina investeringsbeslut.

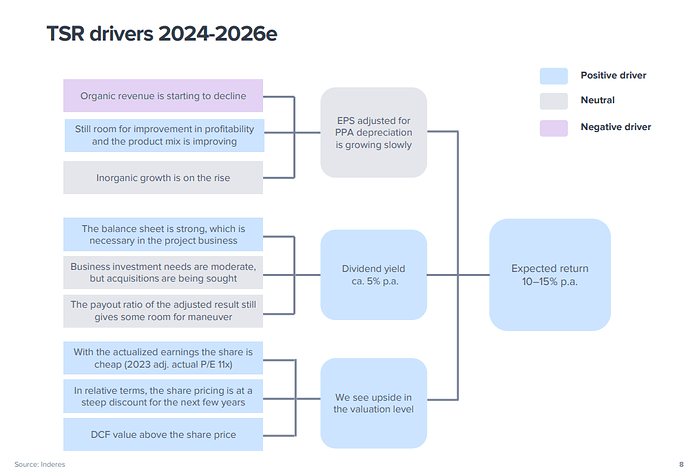

Investerarna blev överraskade av varningen, och aktiekursen sjönk med nästan 7,8 %. Orderstocken är stark, och den stabila verksamheten utgör nu en betydligt större del av företagets order jämfört med för tio år sedan.

Inside information, negative profit warning: Valmet estimates that Comparable EBITA in 2024 will remain at the previous year’s level

Valmet Oyj’s stock exchange release (inside information) on October 11, 2024 at 4:05 p.m. EEST

Valmet changes its Comparable EBITA guidance for 2024. For net sales, the guidance remains unchanged.

The services market has developed somewhat slower in EMEA, China and Asia-Pacific than Valmet earlier expected. Furthermore, the market activity in board and paper process technologies has been slower than earlier expected and some customers have postponed their final investment decisions.

New guidance for 2024:

Valmet estimates that net sales in 2024 will remain at the previous year’s level in comparison with 2023 (EUR 5,532 million) and Comparable EBITA in 2024 will remain at the previous year’s level in comparison with 2023 (EUR 619 million).

Previous guidance for 2024, issued on June 13, 2024:

Valmet estimates that net sales in 2024 will remain at the previous year’s level in comparison with 2023 (EUR 5,532 million) and Comparable EBITA in 2024 will increase in comparison with 2023 (EUR 619 million).

Thomas Hinnerskov, President and CEO:

“While we expect net sales and Comparable EBITA to remain at last year’s level in 2024, we are fully committed to continuing the journey towards reaching Valmet’s financial target of 12-14% Comparable EBITA.”

![]()

![]()