Här är en ny analys av Tietoevry. Det är värt att läsa. ![]()

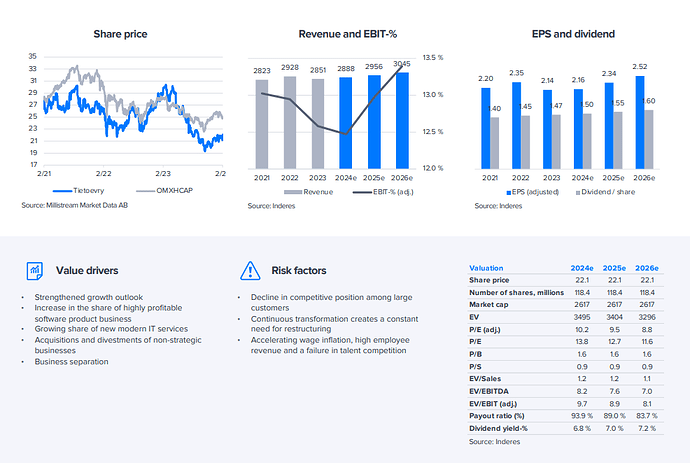

Tietoevry’s Q4 was operationally in line with expectations, guidance was slightly soft and dividend a bit below expectations. Driven by a challenging market, we cut our forecasts a tad. We expect the earnings to be at the level of the comparison period, due to a challenging market, but to grow moderately in the coming years. Our forecasts are clearly below the company’s target levels. The share’s valuation picture is still moderate from several angles (2024e P/E 14x, adj. P/E 10x, DCF EUR 29, SOTP EUR 28 and expected return ~15%) and business areas to be demerged provide drivers to dissolve the undervaluation.