New stock analysis on Stockmann! ![]()

I´ve followed Stockmann for a few years already and I´ve had it in my portfolio a couple of times.

As a general personal opinion I´ve turned an inch more careful with many value stocks. I can name a few stocks on the finnish exchange that could release a lot of cash or hidden value, but for these stocks to thrive in the future, one must assume that the capital is either invested with a good ROI or returned to the owners. However, I have a bad feeling that many companies aren´t good on capital allocation. So this has made me a little more cautious.

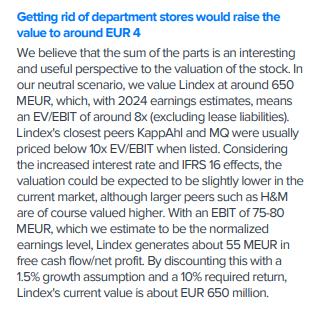

When it comes to Lindex, they have an impressive track of growth. So the question is how can they start the next growth phase. Until now, they´ve been burdened by Stockmann, but if Stockmann is divested they´ll have an open lane to go for their own ambitions. It´s going to be interesting. But when it comes to myself, I think I´ll follow this story with no stock exposure.

This may interest those reading this thread. ![]()

Stockmann kommer att publicera sina kvartalsresultat för Q3 på fredag, och här är analytikerns kommentarer.

Analytiker Rauli Juva:

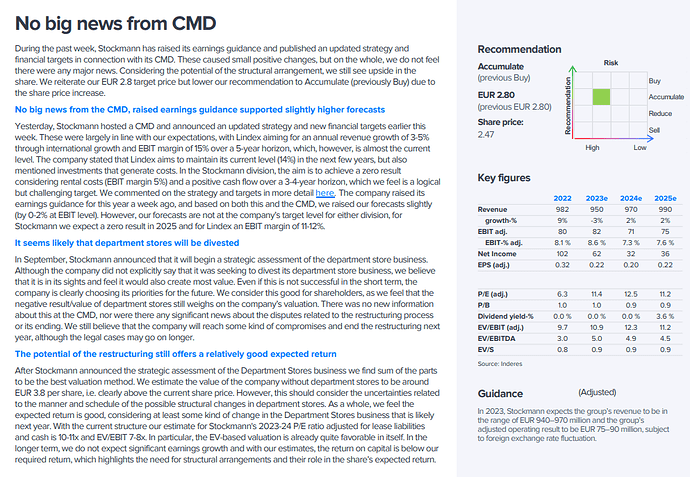

Stockmann updated its guidance on Friday for the second time this year by lowering the top of its revenue guidance and raising and tightening its earnings guidance. The company now expects adjusted EBIT to be EUR 75-90 million, while our forecast is EUR 80 million. We are slightly below the mid-points of the new guidance in terms of both revenue and EBIT. We do not make forecast changes at this stage, but the pressure in the forecasts is slightly upwards, considering the new guidance.

Here is a new analysis of Stockmann. It’s free and high-quality. ![]()

We still see potential in the stock, supported by the structural arrangement that is likely to progress next year. We raised our forecasts slightly in this report, mainly due to the stronger SEK.

@rauli.juva and I discussed about Stockmann as an investment. ![]()

Here is an analyst comment of interest to Stockmann’s shareholders.

Stockmann kommer att publicera sina Q4-resultat på fredag och här är analytikerns kommentarer om detta. ![]()

@Aili, jag tror att du har ganska bra kunskap om det här företaget, vad förväntar du dig av företaget under år 2024?

Stockmann has gathered some interest in the swedish press “. Succén för klädesmärket Lindex och strategiomläggningen har gjort den anrika doldisen Stockmann urbillig. Aktien har potential att dubblas, skriver Dagens Industri i analysen “Veckans aktie”. (DI-mån)”

På senaste tiden har det varit mycket intressanta nyheter och pressmeddelanden om detta företag. ![]()

“Sätter vi en multipel på tolv gånger det justerade rörelseresultatet – H&M värderas till 14 gånger rörelseresultatet (ev/ebit) enligt databasen Factset – får vi ett värde på drygt 12 miljarder kronor. Givet att Stockmann har ett börsvärde på strax över fem miljarder kronor i nuläget innebär det att denna doldisaktie har förutsättning att mer än dubblas, bara värdet i Lindex synliggörs”, skriver Di.

Korta intervju med Ehnbåge i Di TV ![]()

Här är en högkvalitativ analys av Stockmann och dessutom gratis. Inderes gör analyser som inte är för “tjuriga” utan pålitliga. ![]()

Stockmann’s Q4 result fell short of expectations but improved from the comparison period. The guidance indicates that adjusted EBIT will remain at around 80 MEUR as in the previous two years. The main driver of the share continues to be the progress of the restructuring, which we will hear news about this year.

Aktuell analytikerkommentar av @rauli.juva ![]()

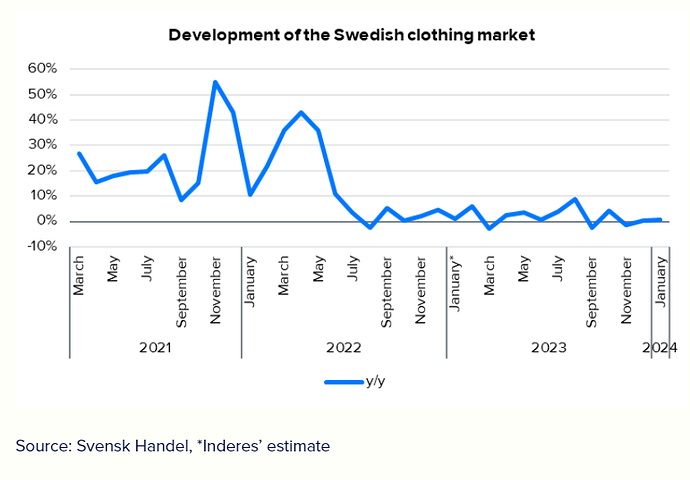

Utvecklingen över Svensk handel, klädindustri: se graf nedan!

Analytikers kommentarer om handelsföretagens situation ![]()

The target market for Kesko’s daily goods trade, Tokmanni and Stockmann (department store and hypermarket chains) grew by 3.5% in January. A decline was seen in consumer goods (-1%), while revenue in food grew by 5.5%. In consumer goods, the decline was just like in November-December driven especially by clothing (-5%), although the revenue from home and leisure time also decreased slightly (-1%). The trend in consumer goods is unfavorable for both Stockmann and Tokmanni, as their important clothing category has fallen for the past three months.

Februarisiffrorna för den svenska klädmarknaden publicerades i morse. Tillväxten i februari stöddes av en extra dag på grund av skottår. Tillväxttakten i början av året ligger strax under 3%. ![]()

Stockmanns namn har ändrats till Lindex. ![]()

![]()

The target market (department store and hypermarket chains) for Kesko’s daily goods trade, Tokmanni, and Lindex (formerly Stockmann) grew by 6.2% in February, a clear recovery from January’s moderate figures. Food grew by as much as 6.7% and durable goods also grew strongly by 4.5%, in contrast to the weak previous months. Within durable goods, growth was split between clothing, up 3.2%, and home and leisure, up 4.9%. Trade inflation has slowed to below 1%, signaling clear volume growth. The performance of Kespro’s Foodservice target market was down 1.5% for the first time in a while, despite one more delivery day than in the comparison period.

Lindex rapporterar Q1:an på fredag. Vi förväntar oss att bolaget i stort sett kommer att prestera på samma nivå som Q1´23. Lindex guidning är att årets justerade EBIT kommer att uppgå till 70-90 MEUR. Vi förväntar oss att bolaget upprepar sin guidning.