In the big picture Nokia’s markets are pretty stable and growing/declining in relation to telecom operators capex budgets (which are pretty stable).

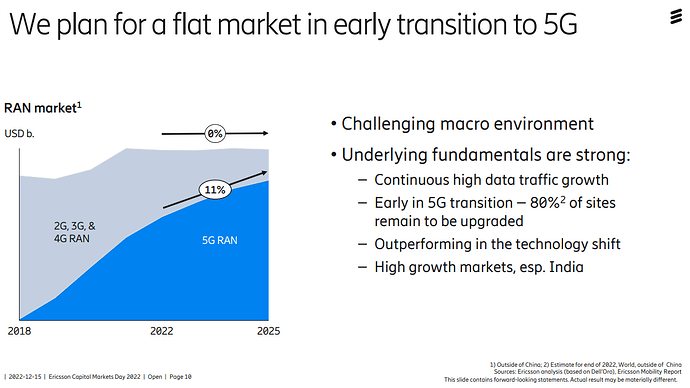

For mobile networks Ericsson was expecting flat market during its CMD on December.

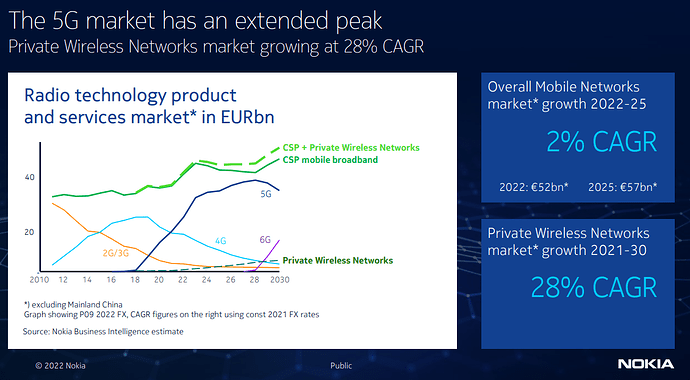

Nokia’s expectations for this decade look like this:

This is a comment from Nokia’s CEO from Q1 earnings call:

Market research firm Dell’Oro published their latest market forecast just a month ago and they are still expecting 1 % growth even though capex budgets are declining this year.

Nokia also reiterated its outlook for 2023 and is still guiding with the guidance midpoint stable earnings for this year. All in all, in a recession it would be really hard for Nokia to grow its earnings, but I think pretty stable development is still achievable. The stock is trading currently with 2023e P/E ratio of 9x so it seems that markets are already pricing in pretty steep decline in earnings. So if Nokia is able to roughly maintain its current adj. EBIT level of +3000 MEUR, it is pretty fair to say that the stock is very cheap at the moment.