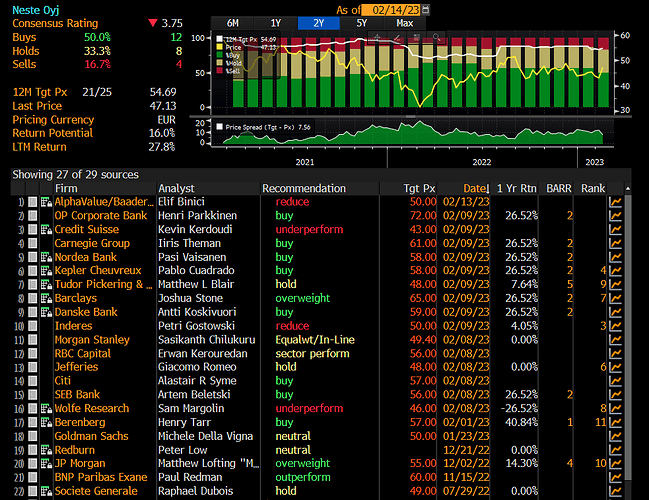

Those views don’t really differ that much when you look at the consensus. The consensus target price, which is the average of all target prices, is now just under 55 euros. The difference between our target price and that is just under 10%, which I think is in the usual ballpark for a company like Neste. That OP’s target price is again the highest, which of course has a bigger difference.

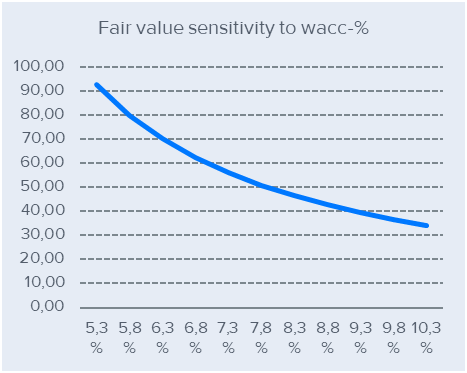

Our cash flow model values the share at just under 51 euros, while the average cost of capital (wacc-%) is 7.8%. Our cash flow model bends to that 70 euro, if I put the wacc-% north of 6%, i.e. a good 1.5% units lower. To my taste, that is currently a rather low wacc-%, and in my view the wacc-% should be higher. Of course, each investor can assess his own return requirement and thereby frame his own view of the company’s value.

Here below is a graph of what our cash flow model gives with the current cash flow assumptions when the return requirement is changed by 0.5% in different directions. Apologies for the graphic layout, that’s a graphic from an old template made a long time ago ![]()