I’m writing my own views on the three topics you listed above.

Aggressive acquisition strategy: I find Hexagon’s M&A strategy successful in general. For our extensive report, we did a analysis of post-synergy valuations of their acquisitions in the past 10 years (2013-22). We compared the money they spent in these acquisitions (net purchase price or EV) to the increase in adjusted EBIT between 2012 and 2022. We of course don’t know how much of their EBIT growth was due to organic improvement and how much due to the acquisitions so we have to assume certain organic EBIT growth rate. If we assume their organic EBIT growth during this period has been 5%, it would assume that the post-synergy EV/EBIT for the acquisitions has been around 10x. Or if their organic EBIT growth had been 8%, the post-synergy EV/EBIT would be around 16x. This approach does not include likely future synergies from the recent acquisitions of EAM and ETQ, which, if taken into account, would result in lower post-synergy multiples for the past acquisitions. We consider that even an EV/EBIT of 16x would be a fair-to-attractive historical multiple for business growing organically some 5% per year (probably even more as the acquired software businesses grow faster than the group on average) and having high return on new invested capital.

Hexagon group’s accounting policies obviously differ from the policies of the companies it acquires which may cause short-term inconsistencies in group figures. For example, the company activates R&D as capex but many companies it has bought recently (e.g. ETQ and EAM) have not done so in the past. So activating new R&D but not having any old intangibles to depreciate naturally boosts EBIT in the short-term. I don’t see anything wrong with it but investor needs to understand it. For my experience, the company has been open about its policies. I can’t judge every single acquisition the company has made or related accounting policies, but in general they seem fine to me.

Lack of transparency:

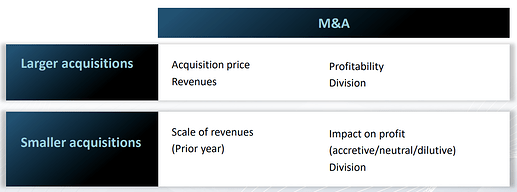

I agree that the company’s disclosure of small acquisitions has been rather scarce in the past. They have given more information about the bigger deals though. In the CMD of 7th December they announced new disclosure policy. In the future this is what they will disclose about M&A. From analyst’s perspective, I find this new policy sufficient.

Front-running: I don’t have any 100% proof evidence from an independent source which version of that story is true. Viceroy claims that Greendbridge front-run Hexagon. Hexagon claims that they invested first and Greenbridge later. Anyway, Hexagon and Greenbridge have agreed to not invest into same companies anymore in the future.

In big picture, I think that Hexagon has not managed its corporate governance perfectly in the past (board composition and Divergent deal at least may look suspicious for an outsider). I guess this negligence might have something to do with company’s success in generating value to all shareholders that has reduced the pressure for change. As the company has grown, the required corporate governance standards have become higher. However, after the negative publicity during summer 2023, they have taken action and I find the proposed measures satisfactory.