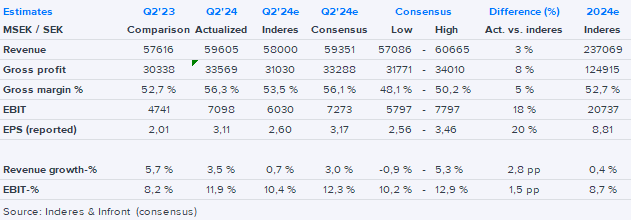

H&M Q2 out this morning. Q2 figures were clearly above our estimates with 3 % growth and a sharp increase in gross margin, however, they were well in line with the consensus.

For June, company sees a 6 % decline in sales, which is obviously weak, and which the company attributes to tough comparisons and weather effects. Company reiterated its goal to reach 10 % EBIT margin this year, but added that it has become more challenging due to “external factors” ie. input costs, have become more negative in H2 than previously believed.

It’s not a surprise that 10 % will not be reached this year as we have been around 8,5 % and consensus around 9 %, but comments regarding the future still look to be on the negative side in our view, even if we need to hike our 2024 estimates due to better than expected Q2.

We also note that opex/sales ratio is not coming down much despite full effect of the restructuring efforts, leaving the improvement to be driven only by gross margin. We believe some of the gross margin strenght might be used to lower prices and hence drive sales going forward.