Analytikern Roni Peuranheimo har gjort en intressant analys av Enento inför deras Q4-resultat som kommer att publiceras på fredag. ![]()

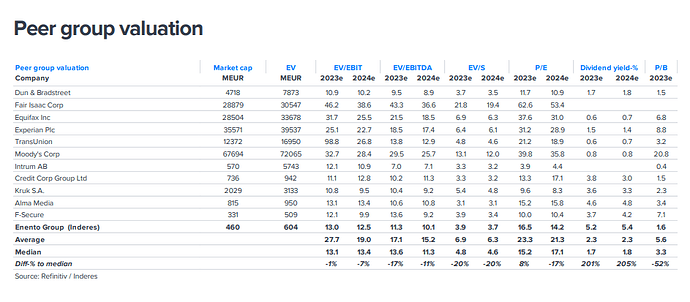

Enento’s operating environment has remained challenging in Q4, and thus we expect the company’s revenue and earnings to continue on a clear downward trend. Due to the weak market development, we have made slight negative adjustments (2-3%) to our revenue and earnings forecasts for the next few years. With the share price rise, the strongest undervaluation (2024e adj. EV/EBIT 12.5x and adj. P/E 14x) has dissolved, but we still find the expected return consisting of earnings growth and dividends attractive.