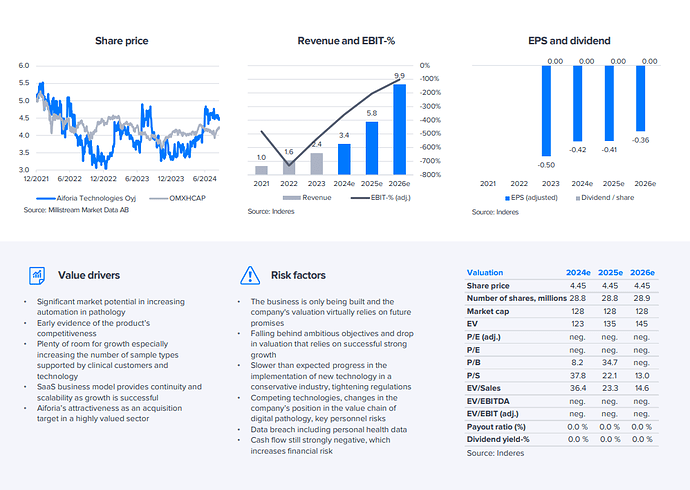

This is an exciting company; many see a lot of upside potential… but there are risks as well. ![]()

Aiforia’s revenue growth stalled in the first half of the year, particularly in the US, although recent months’ customer wins suggest that the company is continuing to capture the market. Our near-term forecasts have been reduced significantly and we now see a more likely need for additional capital, but customer wins and good sales prospects have improved visibility on revenue growth. After the share price increase (+17%), we think the stock looks quite correctly priced. We reiterate our EUR 4.6 target price and switch our recommendation to Reduce (previous Accumulate).