Smart Eye is missing a company thread so its about time we get one started!

Company in Brief

What is Smart Eye? They are a technology company focused on “Human Insight AI”.

In practice, they develop systems that analyze human emotions and attentiveness from videos. Their products include cameras and analysis software. Smart Eye focuses on two use cases / markets: 1) Behavioural Research and 2) Automotive interior sensing. In the latter, Smart Eye is preventing road accidents with camera systems that monitor how attentive drivers of cars/trucks etc. are and make sure that e.g. they don’t fall asleep while driving.

Business areas

Behavioural research in 2023 is still larger in terms of revenue. It is a strategic business and helps Smart Eye develop and test new things to measure and analyze from video footage. Smart Eye’s growth focus is within Automotive sector on driver monitoring systems (DMS) and interior sensing, where EU-regulations are forcing car manufacturers to install these systems.

Here’s how they tie the businesses together:

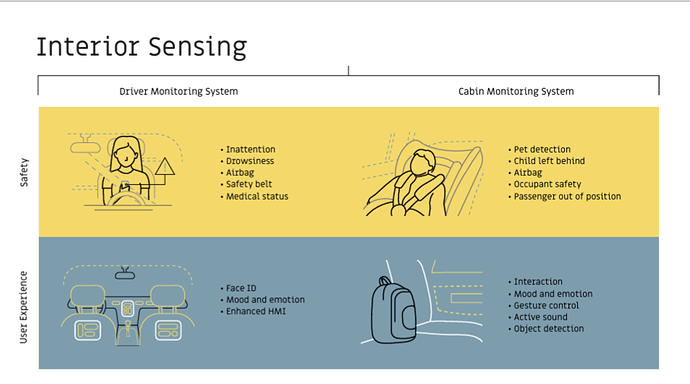

Interior sensing described in 2022 annual report:

Market

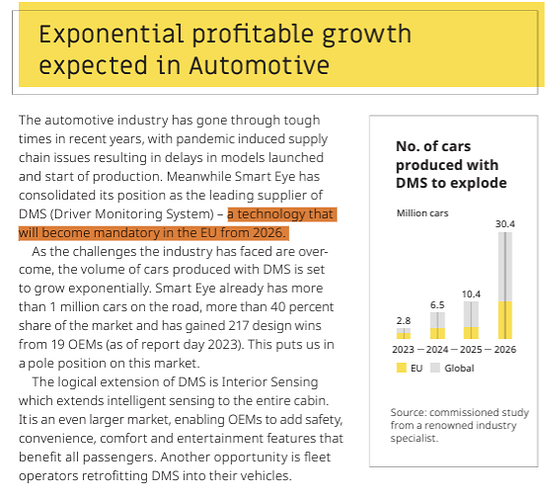

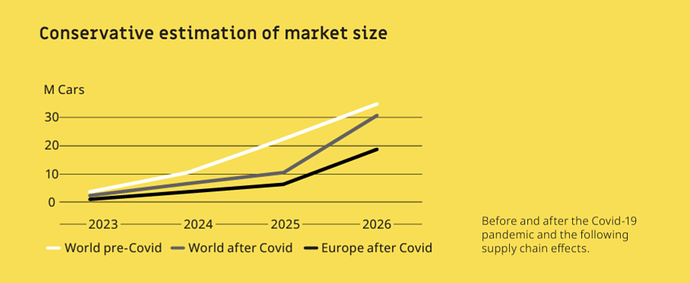

The company is communicating very optimistically about the market growth, which does have a solid grounding in the “regulatory backstop” that forces demand DMS technology use in cars sold in Europe. From 2022 annual report:

Key competitor for Smart Eye in the Interior sensing market is Seeing Machines.

How sales funnel works

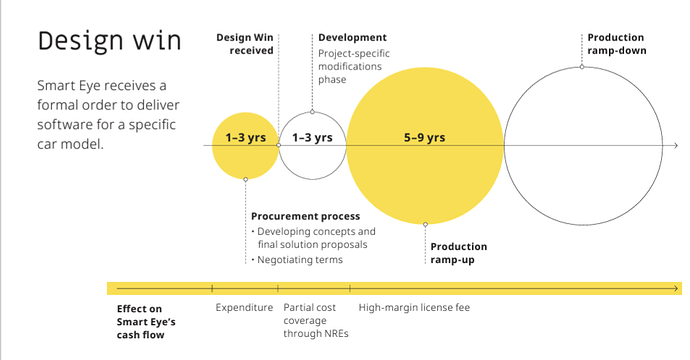

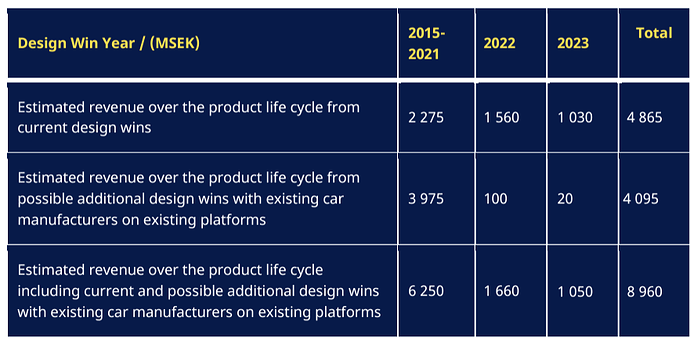

Smart Eye has been building a solid footing in the market and they have won a large number of “Design wins” from Automotive manufacturers. There is quite a long lead time in their sales, and production ramp up (=demand for systems to those produced cars) can take years after a design win:

While in principle design wins should give Smart Eye’s revenue growth some predictability, this is not entirely in the company’s hands. During 2020-2022, in the middle of the Covid pandemic, there were severe component shortages and supply chain issues in the automotive sector, and certain car model launches of Smart Eye’s customers were postponed. This made a dent to Smart Eye’s expected revenue growth as they didn’t get to deliver the DMS systems to these cars, which postponed the prospect of reaching cash flow positivity and required the company to raise more equity. This is is also evident in the stock price of the company. Now as the regulatory back-stops are getting closer, one could expect the visibility to their revenue growth to have improved.

Design-win base from Q3’23 report (more have been announced since):

We interviewed Smart Eye CEO Martin Krantz for Inderes Equity story day. We tried to cover Smart Eye as an investment case here so hopefully this works as a good introduction to what the company is doing and how their strategy & key risks look like:

We have a long (4000+ messages) conversation on our Finnish forum, if you want to read up on what’s been happening since 2020 ![]() requires some Google translate use for non-finnish natives.

requires some Google translate use for non-finnish natives.

Lets continue the discussion on Smart Eye in English / Swedish here ![]()

DISCLAIMER: At the time of writing this message , Smart Eye is not in Inderes research coverage. So this post is written from a higher level view and not with the typical depth of knowledge which we have for companies we cover (and would have spent ~2 months researching when starting coverage). ![]()