Jag skrev några ord i bloggen om Helsingforsbörsens höga utdelningsavkastning samt Kinas problematiska ekonomi. Kina bromsar in, men troligtvis blir det ingen kris.

"For raw material producers and luxury companies, which have benefited significantly from Chinese money over the past decade, the cooling of the Chinese economy is negative. China’s rigidity is probably part of the reason for the weak performance of raw materials in the world. Among Finnish listed companies, KONE in particular has significant exposure to the Chinese construction sector, which is in trouble. There is also no replacement in the global economy for a high-growth economy like China, so the companies that have benefited will have to look for entirely new sources of growth.

However, the overall picture for the Chinese economy is not completely bleak. As mentioned, a crisis in the communist command economy is unlikely. The party puts stability and its own dominance above all else, although it must be pointed out that one-party systems have a historically poor record of maintaining long-term stability.

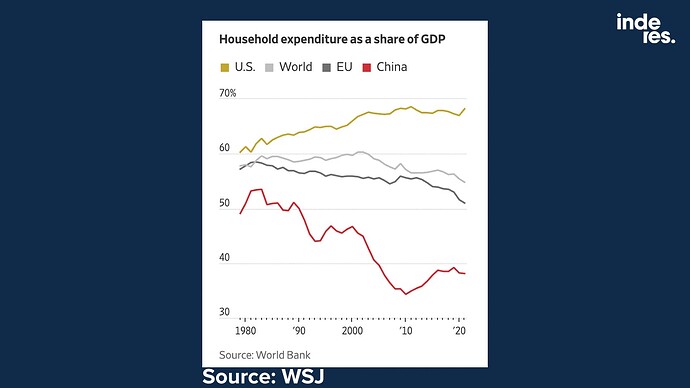

In any case, China also has a political option to offset weak domestic consumption. In China, household consumption accounts for only 40% of the economy’s GDP, compared to 70% in the US and over 50% in the EU. This will require more income transfers to households, i.e., redistributing the slices of the economic pie."