Nordeas uppdaterade tankar:

Aspo: Strategy execution is the key in the medium term

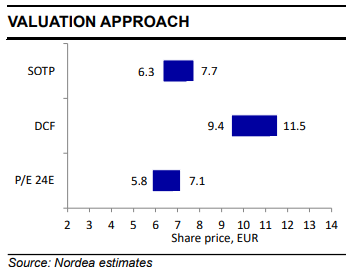

"The new strategy has led to many changes in the group structure and also in reporting. The increased complexity could even reduce visibility and lower the accepted valuation multiples, but the share price has considerable upside potential if the strategy execution is successful. Our current estimates point to a fair value range of EUR 7.3-8.9 per share, based on an equal weighting of our DCF, P/E and SOTP valuations.

The company’s aim is to maximise shareholder value by streamlining the balance sheet and optimising investments, and via further acquisitions and divestments. Aspo’s ambition is to increase EBITA by ~130% by 2028 compared to 2024, which is why its current valuation does not look overly challenging if the strategy execution is successful."