Chip industry illustrates the classic from shortages to glut -cycle.

No wonder that semiconductor stocks have lost ~40 % of their value this year.

Chip industry illustrates the classic from shortages to glut -cycle.

No wonder that semiconductor stocks have lost ~40 % of their value this year.

The majority of strategists and investors wait for more trouble this year. Stock bottoming later this year amid recession seems to be the concencus.

But if we look at the economic data in the largest economies its hard to be that bearish.

For example, China is going to pick up later this year. Subway data is already improving in some cities, indicating more economic activity.

Germanys economy, Europes largest, is in reasonably good condition. Despite the energy crisis, unemployment is still low (5,5 %). This chart is interesting. The hit to gas intensive sectors is somewhat compensated by the revival of chip intensive sectors.

Rising interest rates are seen as negative for indebted households, especially in the Nordics. But in most of Europe people don’t have much mortage and many own their house outright. Rising interest rates actually support income, because many Europeans have huge savings.

In the largest economy of the world, the cycle we saw was not that hot in terms of investments. So it is reasonable to assume that the recession wont be as severe as many investors anticipate. There is no boom bust cycle to recover from.

I wrote about these issues in the latest post.

One thing is certain: there is no escape from macro-related topics this year! 2023: Making Macro Hot Again ;)! ![]()

Few graphs from the latest post.

European stocks and especially cyclicals have outperformed recently despite the so-called “recession”. Here I juxtaposed ISM Manufacturing index and euroarea cyclicals stock index. These have seen a strong diversion recently. Investors are waiting short recession, or China opening makes them happy?

Economic surprises continue with positive note.

Earnings season is beginning! SP500 earnings “growth” is expected to be -4,1 %. Analyst estimates have crashed recently.

We can not talk about actual earnings recession though. Earnings should continue growth H2’23 per concensus:

This might seem too rosy questimate, because especially previous recessions destroyed earnings:

But, somethings are different this time. For example, households balance sheets are strong. They have plenty of cash. That was not the case in 2008 nor in 2000. Strong household spending supports the economy, and strong banks can quarantee that lending continues when needed.

More worrisome long term question is the profitability level of SP500. Can this last? I think mean reversion is probable, superb profitability has structural support from globalization, digtilization, winners takes all effect etc. So, don’t expect profitability to mean revert quickly. But I wonder has competion really disappeared?

Debt ceiling battle lurks around the corner. Yesterday, US hit it’s so called debt ceiling which means it can’t borrow anymore. Since federal goverment runs deficits, this means they will run out of money at some point. According to Bloomberg estimates, treasury runs out of cash around October.

I wrote more about the debt limits effect on market here, but I can summarize that usually it is a non event, but if debt battle escaletes we might see bumpy ride in the market.

Good thread how the bond market is expecting disinflation, not recession.

The biggest asset class in the world – housing and real estate – continues it’s meltdown in the face of rising interest rates and liquidity that is drying up.

The phenomenom is global, but for example in Sweden housing prices have slumped 15 % and Riksbank is forecasting 20 % decrease from the top. Some landlords are already forced to sell properties to cover their debt.

In Europe there is 390 billion euros of maturing debt this year. Of all the junk bonds, the real estate sector has the highest propability of default.

In the US we are now seeing a housing glut, indicating housing recession.

Only time will tell how this meltdown of the worlds largest asset class affects the economy and financial system.

Short note. Generally speaking, buying shares at full employment hasn’t been the best idea, but this time it may be different.

I wrote about “hugger mugger market”: how even good news might not be good for stocks, because they indicate stricter monetary policy for longer.

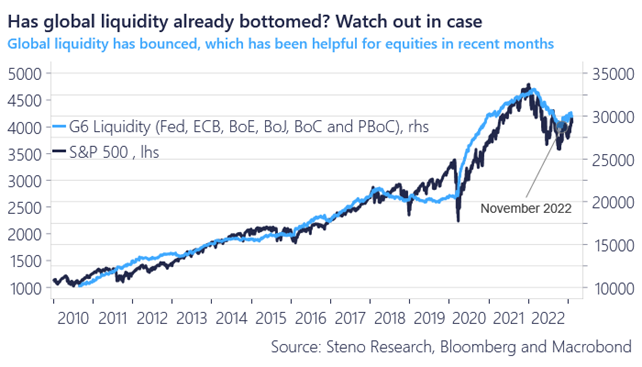

The global liquidity crunch appears to be over, even though the FED and ECB still squeeze their balance sheets. The Bank of Japan and the People’s Bank of China are actively moving in the opposite direction, which has resulted in a shift in the tide.

And if you measure net liquidity for the Fed, that has not decreased since last summer despite QT going on all the time. ![]()

No wonder why markets have performed so well since last autumn!

Alongside the Fed, PBOC (People’s Bank of China) has been injecting liquidity into system at record pace.

The economy should perform at least okay in the nearby future…

The latest economic data dashes pivot hopes.

For example, PMI:s for eurozone point to economic expansion and stubborn inflation pressure. Where is the most anticipated recession in the world?

Bond yields have surged…

Market expectations for ECB rates have gone up with stronger economic picture. Market now expects 3,7 % rate this summer.

Interesting development in the banking sector yesterday. Check banks in the lower left corner.

KBW bank index were sharply lower yesterday as Silicon Valley Bank from California shows signs of stress.

I think in the bigger picture the inverted yield curve matters more, since it makes banks business logic almost unsound. How can you borrow short money in and long out, if short term rates are higher than longer term rates? Especially smaller banks, who compete for savings, feel the heat.

Interesting to follow how this develops. Are recession fears coming back?

This meme described my feelings on Wednesday. ![]() What a week indeed.

What a week indeed.

Central Banks threw in liquidity to banks this week, averting Credit Suisses default.

Fed’s new BTFP programm confirms QT is dead, as I have pointed out for a couple months now.

Here we can see Fed net liquidity development (blue graph) and SP500 (red). Liquidity is doing up. This should support the financial system and markets for a while. At the same time, inflation problem continues but that will be dealt with interest rate hikes (unless banking crisis escalates and soon we have deflation as the main enemy ![]() ).

).

Markets have calmed down a bit after UBS bought Credit Suisse for 3 billion CFH. At the same time, large banks headed by JP Morgan (like in 1907…) are orchestrating rescue operation for First Republic.

While banking crisis should be averted, economy might take a hit from banks being not so eager to lend anymore.

Financial conditions have already tightened rapidly in recent weeks, with no junk bonds sold in the US, for example, for almost three weeks. For indebted firms, the prolonged situation is a drag. This graph shows the US and eurozone monetary indices. In the eurozone, the situation is actually even tighter than in the euro crisis. I hope this is not a hint of things to come.

I wrote more about the banking crisis here

Even though the situation is very unclear, stonks dont look expensive. Historically buying at these levels (forward P/E 12.5) has not been a bad idea.

Few notes from the latest Whatsupwithstonks. ![]()

Fed said yesterday they will keep rates higher for longer, thought rate cycle peak is at hand. Market disagrees. We might have one raise, then cuts cuts cuts and more cuts…

Europe is dodging Putins energy bullet. Our gas storages are 55 % full, while usually they are almsot empty at this point.

With new LNG capacity coming online, Europe might “suffer” from over capacity soon! ![]()

No wonder then with receding energy crisis, healthier rate environment (for banks) and positive gdp growth that Europe overperformed over the last 12 months and I would argue this could continue in the future as well.

Short update on net liquidity… Today small bank deposit statistics will be updated as well. Interesting to see how large bank run they have experienced. ![]()

The banking crisis seems to have calmed down, for a while. At least hysteria in social media has cooled off.

While certain banks have mismanaged their risks, the bigger problem especially in Europe is the crumbling real estate, especially in Sweden.

Many real estate companies are over levered. Short-sellers have taken notice.

Real estate sector is trading 40 % below book value (crisis level valuation), indicating that investors anticipate decreasing real estate prices.

It is no wonder then why banks, especially Swedish banks are among the most shorted banks in Europe. Especially Handelsbanken, which has 30 % of it’s loans in CRE.

This might also explain why Nordea, which has the least exposure to the sector (8 %) trades at premium compared to other Nordic banks.

It’s worth mentioning that short sellers are very enthusiastic. In particular, hedge funds have loaded short positions in the S&P 500’s mini-futures to the greatest extent since late 2011. These many congested short positions have actually been quite good places to buy, although the past is never a guarantee of the future…

Equities live from expectations, and inflation has no longer surprised negatively. If something is already priced in, it will no longer move stocks. The worst thing for equities is rapid and unexpected inflation that jumps out of the blue. Stocks are then re-priced quickly in an environment of high interest rates. The better interest you get on your money today, the less you pay for tomorrow’s cash flows from risky stocks. Now this shock is behind us. This graph shows the Citi Bank Inflation Surprise Index. The higher the figure, the worse the inflation data has exceeded expectations. The latest data has already started to fall short of expectations.

Today we get more inflation data from March.