In this thread general discussion about where the overal market is heading is welcome. ![]()

I’ll start with some narrative about this year, which has been a rollercoaster for investors. Narratives are just, well narratives but I think when supported with ample amount of data one can really create some insights into the market.

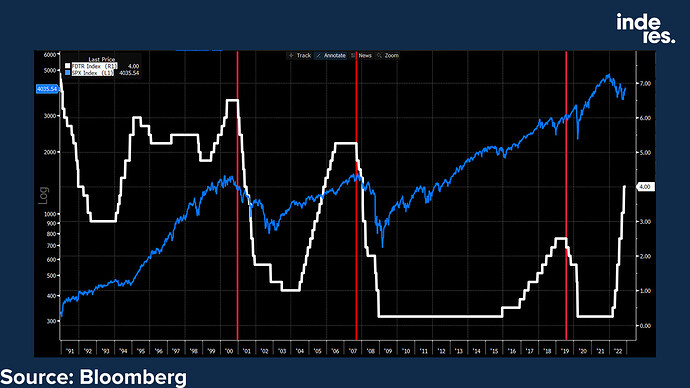

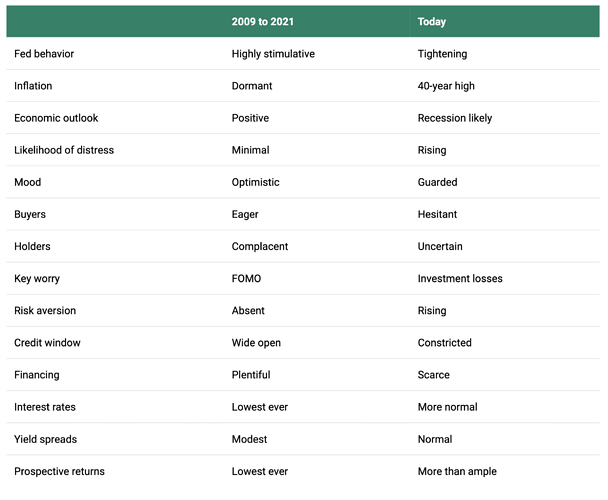

In the long run, cash flows determine the value of companies. The higher the return companies get to their cash flow via investing it, the more valuable companies are. How valuable those future cash flows are today is determined by the discount rate.

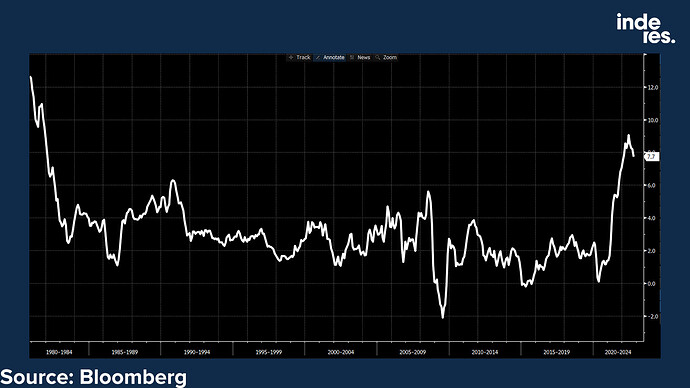

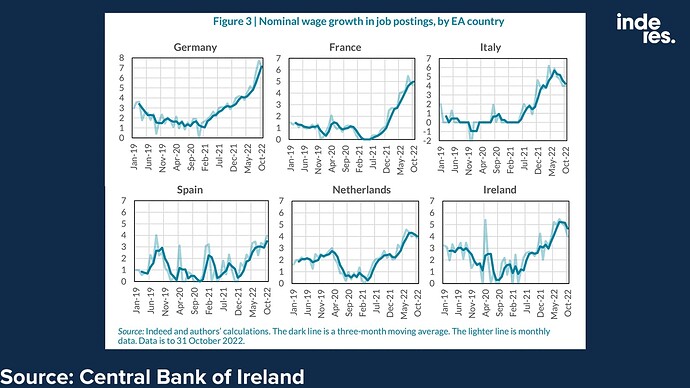

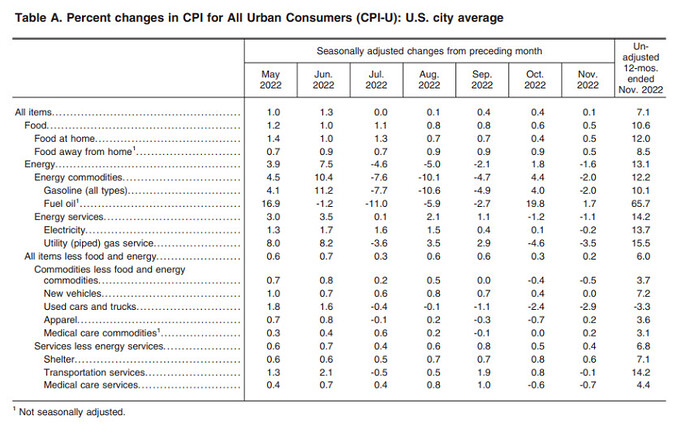

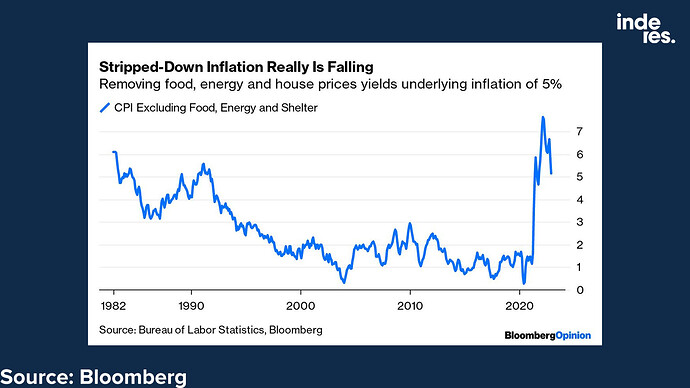

Inflation affects the discount rate. Here is the last 30 years of CPI (consumer price index) data from the US, but the picture is the same here in Europe as well. Inflation has gotten out of hand after the pandemic disruption and gargantual amount of fiscal stimulus. This mixed with bottlenecks and numerous other factors, resulting in run away inflation.

Sudden, unexpected inflation is not a good thing for the stock market in general. It’s difficult for the companies to adapt quickly. Expenses rise, but revenue has trouble to keep the pace. Investing is more expensive and asset base is bloated reducing the ROI. For most companies, this leads to lower valuation over time. I warmly recommend reading Warren Buffett’s comment’s on inflation back in the seventies and eighties. They are as accurate today as they were back then.

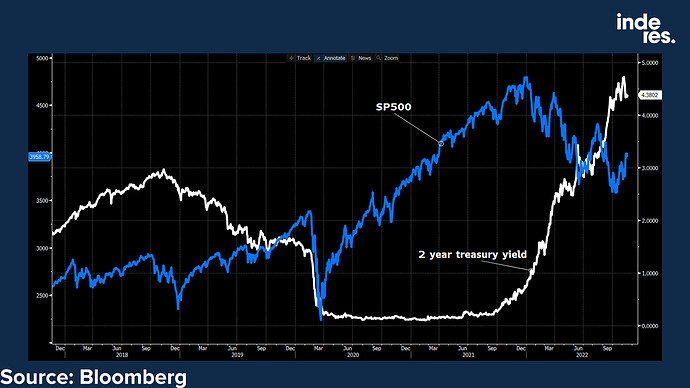

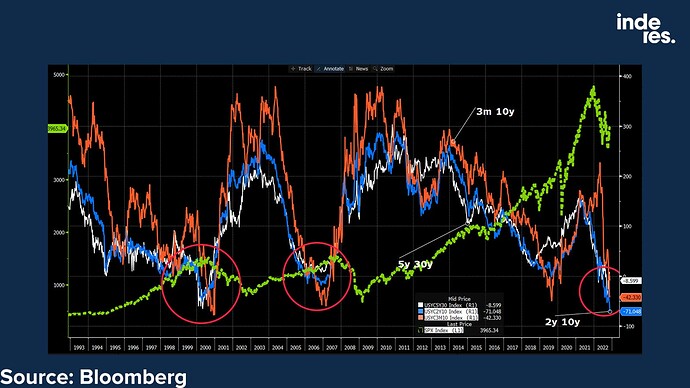

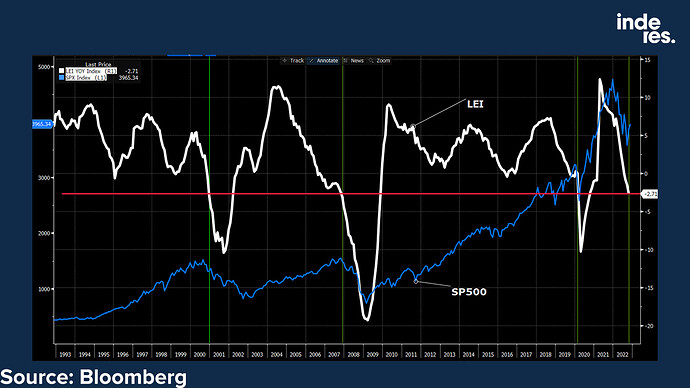

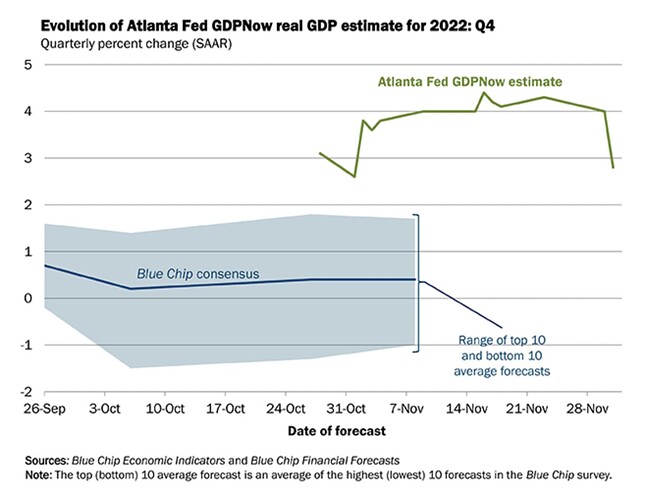

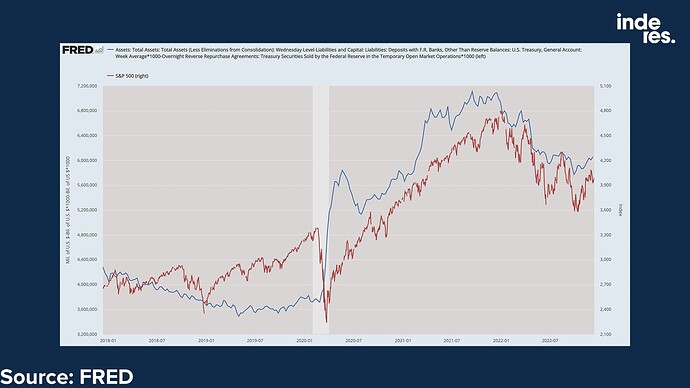

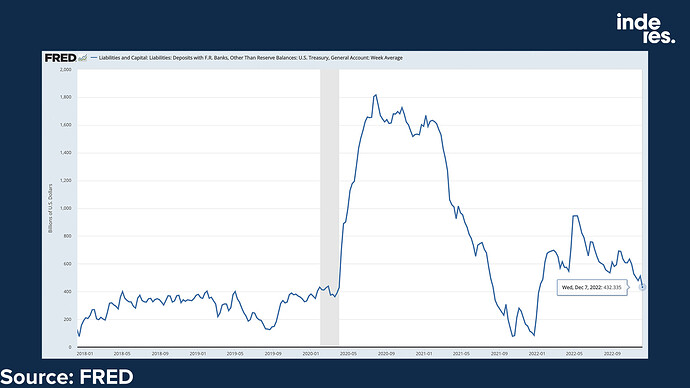

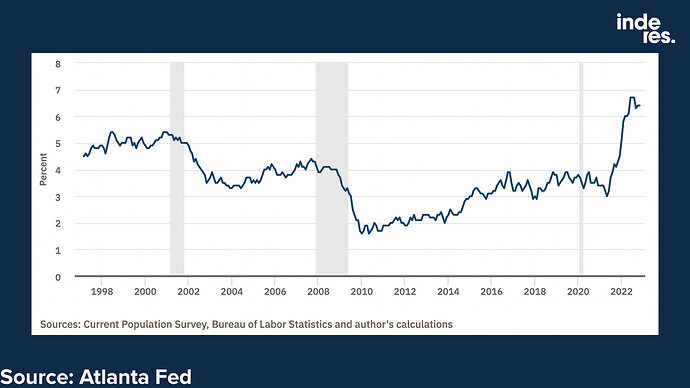

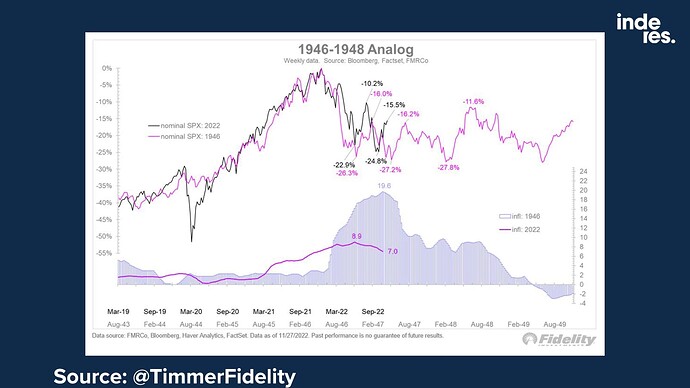

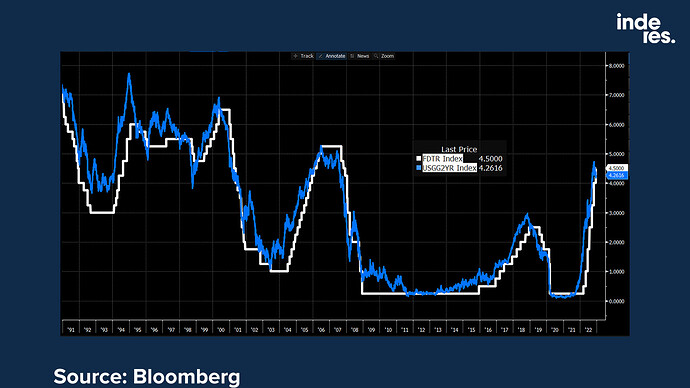

It is no coinsidence that SP500 and other indices started their decline almost at the same time as interest rates started galloping up. Short term interest rates reflect the short term policy rate and actions of the central banks. Rising interest rates reduce the present value of future cash flows.

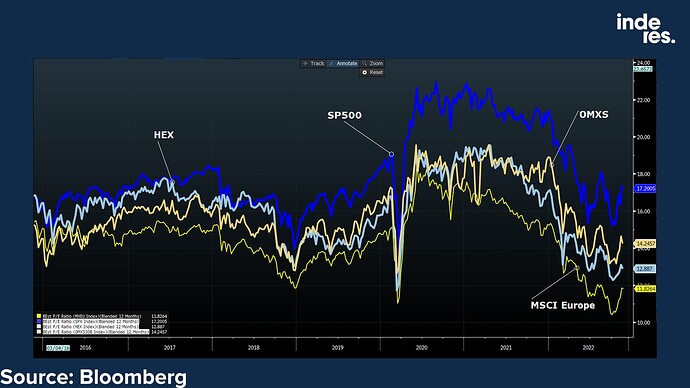

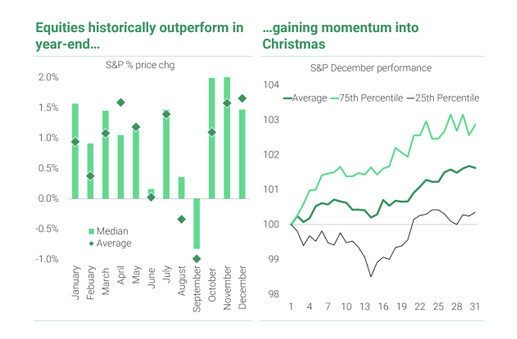

And stocks have definately gotten cheaper after the “COVID bubble” or “growth bubble”, whatever we should call the craziness that happened last year. SP500 traders always at a premium because of better growth prospects and return on capital, but especially European stocks look still cheap.

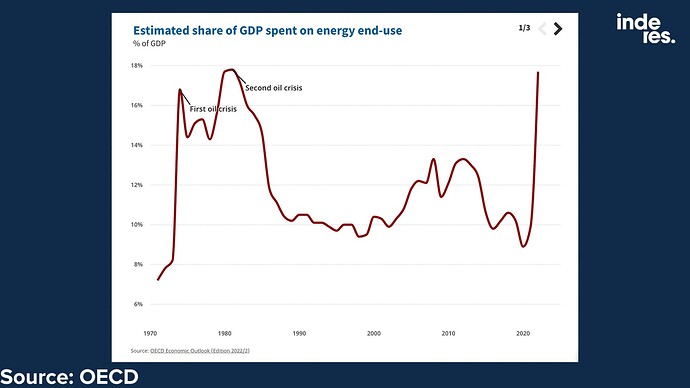

I know, we are directly hit by the energy crisis. It’s a bit question mark for myself what are the long term impacts of the energy crisis to our structural competetivines. However, thus far everything has been more smooth than expected.

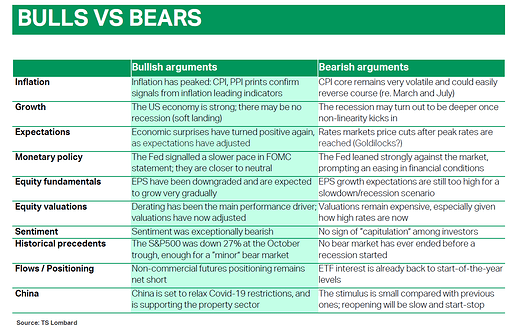

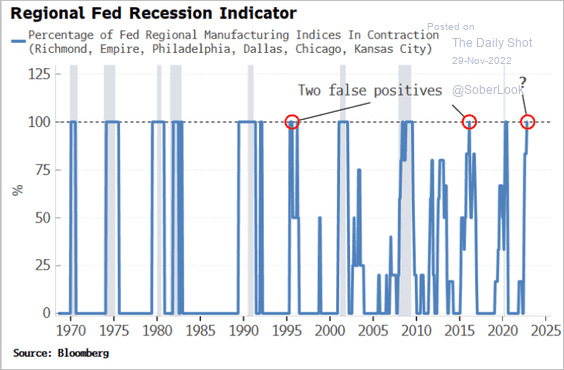

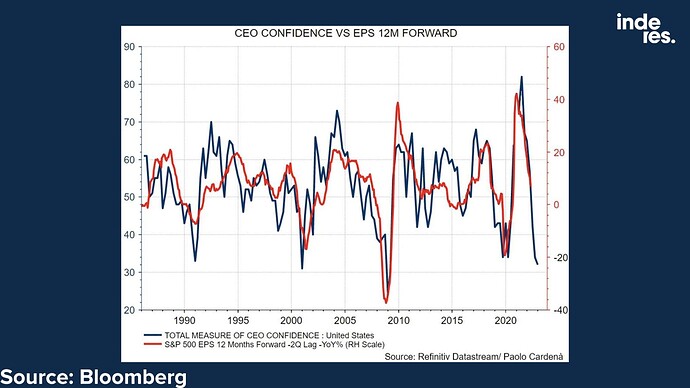

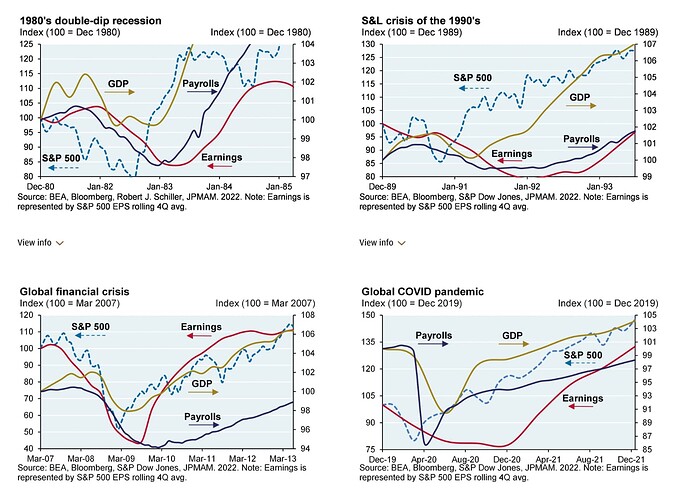

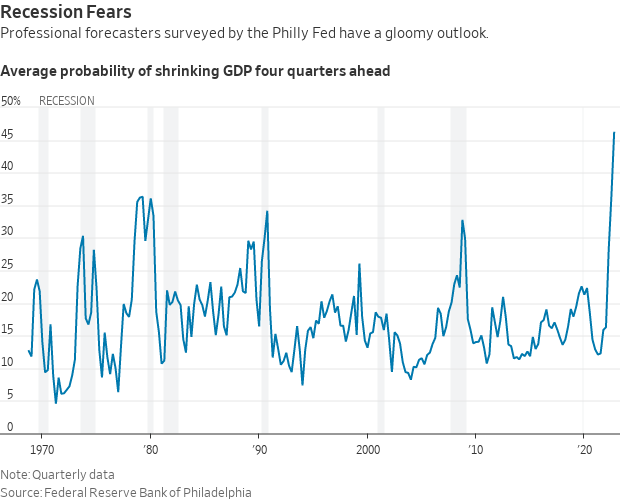

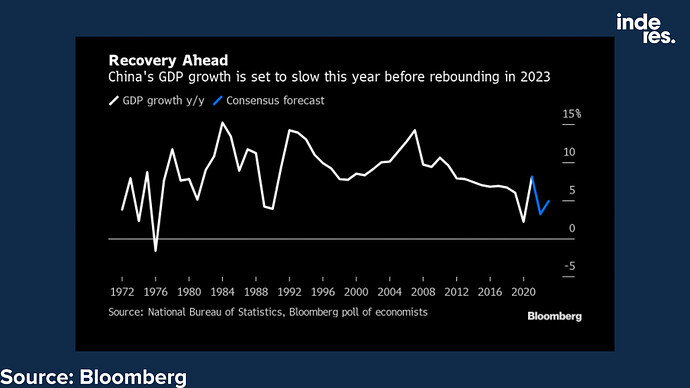

It is no wonder why equities react so vehemently to every sign inflation is receding. That would drive down the discount rate. If this can be achieved without recession, all the better. But that is the big question: can inflation recede without a recession. Recessions weight down earnings. Luckily the stock market has tanked already, so shallow recessions seems to be in the cards.